Aptiv: Sell-Off Seems Overdone

Aptiv's fundamentals remain strong despite weakness in the EV market, with long-term structural growth drivers remaining intact

While Aptiv APTV 0.00%↑ sold off 18% after the third quarter results, I saw this move as somewhat overdone and excessive from a business fundamentals point of view.

On the positive side, Aptiv was able to drive operating margin and EPS growth as a result of its cost efficiency initiatives and share buybacks.

However, on the negative side, Aptiv was negatively affected by vehicle production numbers at certain customers that were worse than anticipated last quarter along with poor visibility into the recovery in 2025.

In my view, these headwinds are largely cyclical, while Aptiv’s long-term structural growth story remains, as I will explain in greater detail below.

Caution around production volatility

This is probably the most important point to discuss and analyze in Aptiv’s 3Q24 results, in my view.

To start off, Aptiv delivered $3.6 billion bookings in the third quarter, which was the lowest bookings figure since the start of Covid-19.

I would also note that apart from the weaker than expected bookings, Aptiv also lowered the 2024 bookings target from $35 billion last quarter to $30 billion this quarter.

Management stated the reason for lowering the figure is mainly due to timing related reasons, with most of the shortfall in the bookings figure being pushed to early 2025 and that the reduced bookings target is not a result of any losses in these programs.

To me, the lower bookings target does highlight that the current operating environment continues to be challenging. Given that Aptiv continues to see its bookings pipeline grow in the quarter, the reduction in bookings target likely does reflect that its customers continue to be cautious.

Again, this weakness in the macro environment and overall automotive industry is evident again in the weaker than expected production volumes across the world.

As a result, Aptiv saw revenues fall 6% in the third quarter, coming in 5% below consensus expectations, which were already somewhat downbeat.

By segments, the Signal & Power Solutions (“S&PS”) segment fell by 8% while the Advanced Safety & User Experience (“AS&UX”) segment fell by 1%.

The weaker S&PS segment can be attributed to weakness in the volumes of EVs, which decreased 20% from the prior year, along with 35% reduction in a select large European OEM’s vehicle volumes in North America.

On the other hand, the relatively stronger AS&UX segment can be attributed to strong vehicle launch programs within Active Safety, contributed largely by Aptiv scaling up these programs with Chinese local OEMs, resulting in the China portion of Active Safety revenues growing 26%, which in turn contributed to the 14% Active Safety revenue growth.

While Aptiv is starting to ramp revenues from local Chinese OEMs, there continues to be weakness from the multi-national JVs in China that continues to be the trend in the automotive industry as the local Chinese OEMs continue to gain traction domestically in China.

Apart from all that, I think the fact that management was unwilling to discuss much about 2025 due to continued uncertainty from its customers also resulted in increased uncertainty about what the one-year outlook for Aptiv looks like from here.

Adding to the troubles further was Aptiv’s decision to walk away from providing the growth over market metric this quarter.

With the stock trading at 8x 2025 P/E multiple, I do think that the market is currently assuming no growth for 2025 and future out to the medium term.

While the near-term North America volumes seem uncertain, with Tesla’s Elon Musk expecting 20% to 30% vehicle growth in 2025, this may potentially be a move that can help the situation in 2025.

I do think that the China headwinds get better into 2025 as we lap the first effects of the multi-national JVs in China, alongside the continued ramp with the local Chinese OEMs.

With weakness priced in virtually all the markets today, if we see higher volume, we could see not just revenue inflection for Aptiv, but given the efficient cost structure, margins should benefit as well.

Margins (and buybacks) save the day

The company’s operating margins increased to 12.2% in 3Q24, up from 11.0% in the prior year, despite the fall in revenue base, reflecting strong improvements in efficiency and a focus on streamlining its cost structure.

Operating margin came in 40 basis points higher than consensus expectations despite the fact that sales missed by 5% and a select large European OEM reducing vehicle volumes by 35% in North America.

If we look at the full year 2024 outlook, management still expects to grow operating margin by 130 basis points despite a 2% decline in revenues.

Aptiv repurchased around $3 billion of shares in 3Q24, larger than the $1 billion repurchased in all of the first half of 2024.

This lower share count helped drive EPS growth of 41% despite the revenue falling 6% in the quarter.

This tells me that the streamlining of the cost structure and share repurchases are helping drive margin expansion and generate shareholder value despite weakness in the environment causing revenues to decline.

This also means that when the market turns, when automotive volumes recover, Aptiv will be a highly lean and efficient company with strong operating leverage growth to come.

Setup for 2025 and beyond

I think that depending on the time frame, the opportunity set for Aptiv could look different.

Given that commentary on 2025 is limited due to high levels of uncertainty, near-term catalysts from a one year perspective may also be limited.

However, management will likely continue to focus on cost and productivity, along with generating shareholder value, so for 2025 and beyond, we are likely to continue seeing upside in areas in which management can control.

For investors with more than 1-year investment horizon, the risk reward skews positive.

This is because the structural medium term growth story for Aptiv continues to be there, in my view, and that the current weakness is cyclical and a result of industry weakness rather than any deterioration of Aptiv’s fundamentals.

The structural medium-term growth story continues to lie on electrification, autonomy, and increasing content spend per vehicle, all of which continue to be intact today.

The EV market is expected to grow 14% from 2024 to 2032, while the global autonomy market is expected to grow 32% through 2030.

In my view, these structural long-term drivers remain intact despite cyclical weakness in the automotive market today.

Valuation

Aptiv now trades at just 8x 2025 P/E.

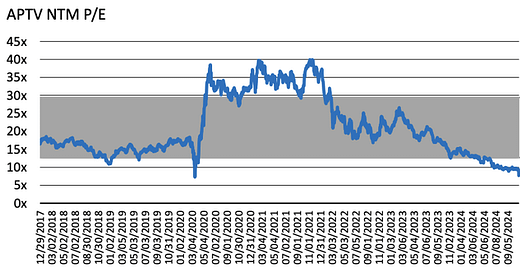

For context, I created the historical NTM P/E chart for Aptiv below.

Aptiv has historically traded between 12x and 29x NTM P/E, which is at a premium to its peer group average of 9x given its above average growth, margin and return profile.

For me to explain how cheap Aptiv shares are today, if we assume no earnings growth in 2025, Aptiv’s EPS would be $7, compared to the $6.15 EPS 2024 guidance shown above.

EPS grows 14% in 2025 despite any earnings growth due to the continued share buybacks.

With that, it does imply that the market is pricing Aptiv such that it is a no growth company or ex-growth company, which is not the case in my view.

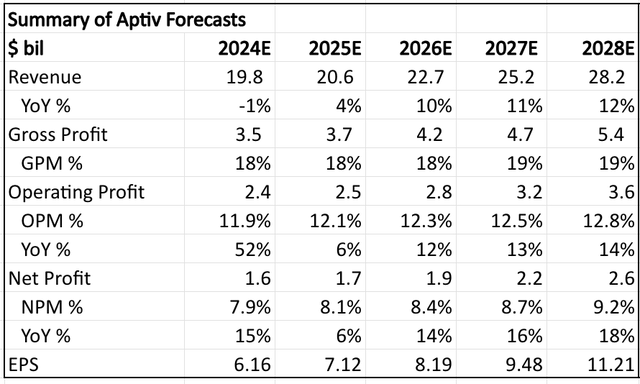

For 2024, my forecasts for Aptiv’s revenue, operating profit and EPS are largely at the midpoint of its guidance range. This guidance range implies weak volume production growth and embeds an assumption of an uncertain and challenging macro environment.

For 2025, I am forecasting a modest 4% revenue growth, although I expect a larger inflection in 2026, given the continued uncertainty around 2025.

I assume modest operating margin expansion in 2025, alongside continued share buybacks, thereby driving EPS growth of 16% in 2025.

I am assuming an acceleration in 2026 and after, with the corresponding revenue acceleration driving operating leverage to bring operating margin expansion through 2028.

My intrinsic value for Aptiv is $92, based on my discounted cash flow model. This assumes 12x terminal multiple and 11% cost of equity.

My 1-year price target is based on the 2025 EPS found above, multiplied by 12x 2025 P/E multiple.

This brings my 1-year price target to $85.

Likewise, my 3-year price target is $114, based on 12x 2027 P/E multiple.

I think that 12x 2025 and 2027 P/E multiple is justified for Aptiv.

This represents a 33% premium multiple relative to its peer group average, not just because of its continued strong buybacks that generate shareholder value, but also its above average long-term structural growth rates due to higher exposure to the electrification and autonomy themes, while also have an above average margin profile due to strong execution from the management team.

Conclusion

I continue to see Aptiv as an attractive player within the automotive industry.

When the cycle turns, bookings and revenue will reaccelerate sharply, while the efforts to improve margins and cost structure in the past few quarters will bear fruit.

With the continued share buybacks and focus on costs and productivity, Aptiv is essentially doing what it can to improve shareholder value while waiting for the inflection in the automotive market to come.

As mentioned in the article, for now, there continues to be uncertainty about 2025, with more visibility likely to bring the stock back up. However, from a longer term point of view beyond 2025, I think the risk reward skews positive given the structural medium term growth story for Aptiv continues to be intact.

I think taking advantage of the current cyclical weakness will enable long-term investors to do well given Aptiv's fundamentals remain solid.