This will be a comprehensive deep dive into Arista Networks ANET 0.00%↑ .

I will be starting first with a brief introduction into the company, understanding its business mix, products and business model.

Then we go into differentiators of Arista, including EOS, CloudVision, and merchant silicon, amongst others.

After having a good understanding of the company, we will go into Arista’s AI tailwinds coming from ramping AI back-end customers, growing inference demand and how it’s well positioned for the next AI wave.

We will then look deeper into Arista’s competitive landscape, how it stands and positions amongst competitors, and some of the key risks for the company

I will conclude with my investment thesis, valuation, and final analysis for Arista.

These are the sections to the Arista deep dive:

Part 1:

Introduction

Business mix

Products and business model

EOS as a differentiator

CloudVision seals the deal

The merchant silicon advantage

Strong AI tailwinds

Oracle, Stargate and xAI

Advantages in AI inference workloads

Back-end AI customers

Ultra Ethernet Consortium

Part 2:

Management and capital allocation

Competitive analysis (positioning, market share, industry, customer feedback)

Investment thesis

Financials

Valuation

Conclusion

Introduction

Arista Networks is a leading provider of high-performance cloud networking solutions, known for its cutting-edge Ethernet switches and software.

Arista was founded in 2004 by Andy Bechtolsheim, Kenneth Duda, and David Cheriton, to revolutionize datacenter networking.

Today, Arista is led by CEO Jayshree Ullal, who joined Arista in 2008 and was a former Cisco executive.

Arista’s core product line consists of multi-layer network switches that deliver ultra-low latency and high throughput, underpinned by its proprietary Extensible Operating System (“EOS”) software running on all devices. (EOS is mentioned much more in later sections)

These switches support speeds from 10 Gigabit up to 800 Gigabit Ethernet, catering to the massive scale and speed requirements of cloud computing, high-performance computing, and high-frequency trading environments.

Since its founding in 2004, Arista has reached major milestones like its IPO in 2014 and reaching $7 billion in revenue in 2024.

Business mix

Before going deeper into Arista, an understanding of its business mix will be useful to determine where to focus our efforts on in the later sections.

65% of its 2024 revenues come from the Core category, which includes its data center, cloud, and AI networking businesses.

This is not surprising as Arista has achieved a leadership position in overall data center Ethernet switch market, particularly in higher-speed Ethernet port shipments of 100G and above, which are foundational for high-performance AI infrastructure.

When looking at its business by customer mix, it is also no surprise that Cloud and AI titans make up almost half of 2024’s revenues.

The Enterprise segment is another important segment for Arista. The company has a wide breadth of enterprise customers, including financial services organizations and government agencies and it continues to diversify the types of enterprise customers it sells to and expand across a wide spectrum of industries including media and entertainment, healthcare and education, amongst others.

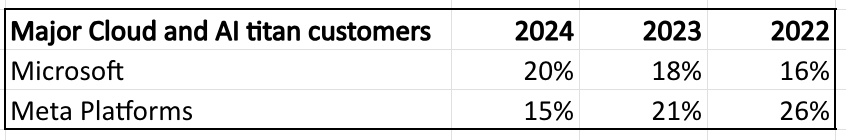

To share more information on this Cloud and AI Titans group, Meta Platforms META 0.00%↑ and Microsoft MSFT 0.00%↑ both contribute 35% of Arista’s 2024 revenue in aggregate.

Meta Platforms made up 15% and Microsoft made up 20% of Arista’s revenues in 2024.

To be fair, Arista saw Microsoft and Meta Platforms contribution as a percentage of revenue fall from 42% in 2022 to 35% in 2024.

However, I continue to expect that Arista will continue to have itis revenues dominated by these Cloud and AI titan customers but perhaps diversify it across the other hyperscalers.

As I will highlight below, Oracle ORCL 0.00%↑ is emerging as another growing relationship for Arista, with the company highlighting Oracle as a major customer in October 2023 (More on this below).

Since we are on the topic of customers, Arista does count Apple AAPL 0.00%↑ among its enterprise customers, although Apple isn’t disclosed as one of its top-tier hyperscalers like Microsoft or Meta Platforms.