Broadcom: Where will the upside come from in 2025

VMware synergies, very strong AI semiconductor growth from networking and custom ASIC, non-AI bottom reiterated

Broadcom AVGO 0.00%↑ recently joined the exclusive $1 trillion dollar club and it is now the 10th largest company in the world.

Today, in this article, I wanted to go through the opportunity set around Broadcom in 2025

Today in this article, I will be going through:

Introduction to Broadcom

4Q24 business review

Guidance

Infrastructure software: VMWare delivering synergies

AI semiconductors

3 key drivers for AI semiconductors

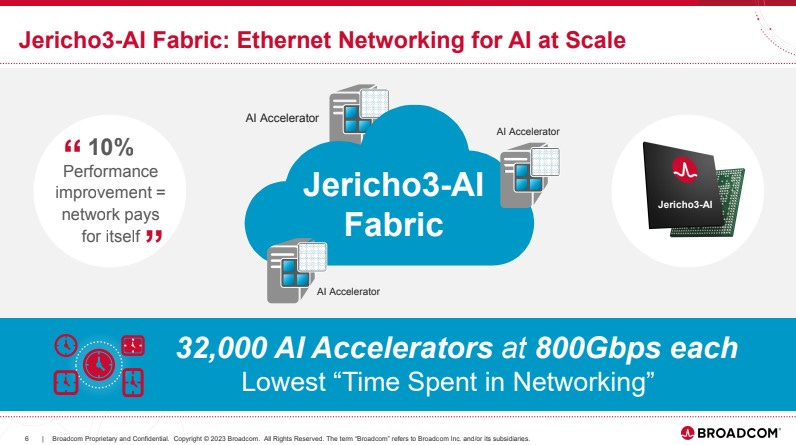

Jericho3 AI

Trillium

2 more hyperscalers

Non-AI has bottomed, recovery in 2025

Valuation of Broadcom

Conclusion

Introduction to Broadcom

Broadcom has two key segments and they are the semiconductor solutions segment and infrastructure software segment.

The semiconductor solutions segment includes networking, server storage, broadband, wireless and industrial solutions.

The infrastructure software segment includes the mainframe, distributed, cybersecurity, storage area networking and cloud infrastructure solutions.

By segment, based on the latest 4Q24 results, the semiconductor solutions make up 59% of revenues, while the infrastructure software segment make up 41% of revenues, with revenues growing 51% from the prior year (as shown below)

However, the acquisition of VMWare has distorted the revenue mix and revenue growth profile of Broadcom.

The acquisition of VMWare led to inorganic growth in the infrastructure software segment.

Excluding the VMWare acquisition, the infrastructure software segment revenue would only be $1.9 billion in 4Q24, largely flat from the prior year, and it would make up only 19% of revenues.

For reference, Broadcom closed the $61 billion purchase of VMWare in late November 2023.

The semiconductor solutions segment revenue mix would then go up to 81% if we excluded the acquisition of VMWare.

The semiconductor solutions segment is the fastest growing segment of Broadcom, contributing to 12% growth in 4Q24.

Within the semiconductor solutions segment, Broadcom’s AI revenue makes up $3.8 billion in FY2023 and this increased 220% to $12.2 billion in FY2024.

AI revenue makes up 41% of the semiconductor solutions segment revenues today.

4Q24 business review

Looking at the most recent 4Q24 quarter, helps give us a snapshot of the current state of the business and a preview into what is coming in the near-term.

The 4Q24 quarter was largely in-line with market expectations.

Revenue was up 8% sequentially to $14.1 billion, which was in-line with market expectations.

Gross margin declined 22 basis points sequentially to 75.8%, which was above consensus of 74.7%, largely due to mix.

EPS came in at $1.15 per share, above consensus expectations of $1.12, largely due to the higher gross margins.

Dividends were raised by 12% from the prior year, with the dividend payout expected to remain about 50% of free cash flow while the other half will be used for debt paydown.

Management remains open to M&A, but with fairly demanding criteria.

Guidance

For the next quarter, FY1Q25, Broadcom guided revenues to be up 4% sequentially to $14.6 billion, which came in in-line with consensus expectations.

Going deeper into the revenue guidance, semiconductor revenues are expected to be down 2% sequentially to $8.1 billion, below consensus expectations of $8.3 billion, while infrastructure software revenues are guided to $6.5 billion, up 12% sequentially, above consensus expectations of $6.3 billion. The beat in infrastructure software guidance was also partly due to the multiple deals that slipped over from F4Q24 to F1Q25.

Infrastructure software:VMWare delivering synergies

Infrastructure software revenue came in at $5.8 billion, flat sequentially as the timing of certain deals, estimated to be about $200 million, slipped into next quarter.

VMWare annualized booking value was $2.7 billion in in 4Q24, up $200 million sequentially, and FY1Q24 is expected to come in at $3.0 billion as perpetual-to-subscription conversions continue and more customers are migrated to VMware Cloud Foundation or VCF.

For reference, 4,500 of Broadcom's 10,000 largest customers have moved to VCF. What VCF does for customers is that it enables them to be able to deploy private cloud environments on-premise as an alternative to running their applications in the public cloud.

As a result, Broadcom has been successful in driving down spending in VMWare.

VMW cost base is now at a $1.2 billion quarterly run rate.

For reference, VMware spending was averaging over $2.4 billion per quarter prior to the acquisition with operating margin less than 30%.

This means that after the Broadcom acquisition, spending is now at half of the rate at the time it was acquired, with operating margins already in-line with Broadcom's legacy software business.

Broadcom only closed the acquisition in the early weeks of FY2024, but it is clear that the integration of VMWare is now largely complete.

In fact, I think VMWare is well ahead of the anticipated timing of delivering an incremental adjusted EBITDA above $8.5 billion from the VMWare acquisition,

This was what CEO Hock Tan said about the progress Broadcom has made on the VMWare acquisition:

“We are well on the path to delivering incremental adjusted EBITDA at a level that significantly exceeds the $8.5 billion we communicated when we announced the deal. We're planning to achieve this much earlier than our initial target of three years.”

I continue to still see an additional $4 billion of incremental annualized revenue in the cards for VMW over the next 12mos.

Management expects the software revenue to grow 11% sequentially in the next quarter, with VMware annualized booking value is expected to exceed $3 billion compared to $2.7 billion this quarter.

Semiconductors

AI

Apart from the first key driver being the VMWare acquisition, the other bigger long-term driver is AI.

AI revenues now make up 41% of semiconductor revenue, growing 220% from $3.8 billion in FY2023 to $12.2 billion in FY2024.

This 220% growth in one year is very impressive and contributed by the strength in custom AI accelerators or XPUs and networking solutions.

Likewise, Broadcom saw similar strength in 4Q24.

Networking revenue grew 45% from the prior year to $4.5 billion.

AI networking revenue grew 158% from the prior year, making up 76% of networking revenues in 4Q24.

What contributes to this strong growth in networking revenues?

Firstly, there was a 4x growth in AI connectivity revenue driven by Broadcom’s Tomahawk and Jericho shipments around the world.

Secondly, Broadcom doubled its AI XPU shipments to its 3 hyperscaler customers.

For reference, going into FY2024, Broaodcom’s target for AI revenues as a percentage of semiconductor revenue was 25%.

And that was increased to 35% during the fiscal year, but Broadcom ended FY2024 with AI revenues making up 41% of semiconductor revenues.

3 key drivers for AI semiconductors (Jericho3 AI, Trillium, 2 more hyperscalers)

This fourth quarter was a strong one for AI semiconductors, but this momentum is expected to continue.

There are 3 key drivers in the next quarter and fiscal year.

Firstly, within the AI networking business, the momentum is expected to continue as more hyperscalers deploy Jericho3 AI in their fabrics.

Secondly, Broadcom stated that it remains on track for volume shipment of one of its hyperscaler customers in the second half of FY2025, which I think is likely Google GOOG 0.00%↑ .

This is in-line with my expectation going into print that Google’s TPUv6 will be more back half loaded in FY2025, while the TPUv5 continues shipments in the first half.

For context, when Google wanted to be a cloud service provider, it knew that it needed to buy compute from the likes of Intel INTC 0.00%↑, AMD AMD 0.00%↑ and Nvidia NVDA 0.00%↑ for its server fleet.

However, the profit margins that Intel used to command for CPUs, and that AMD currently now does command, and that Nvidia still commands for its GPUs in the near future, meant an opportunity for the cloud service provider.

It saw the opportunity to create its own CPUs and AI accelerators, particularly for its internal work, like search engine indexing, ad serving, video serving, and data analytics.

By doing so, Google could lower the total cost of ownership of its server fleet for internal workloads.

As such, Google’s internally developed AI accelerator is called Tensor Processing Unit, or TPU, and it was first used by Google internally in 2015, just 15 months after this project started. In 2018, TPUs were made available for external use.

Today, the latest TPU announced is the 6th version, also known as Trillium.

There is an uplift in ASP for TPUv6 relative to TPUv5 due to the larger die size, and there is also strong unit volumes on TPUv6 as CoWoS wafer allocation is estimated to grow 30% year-on-year for TPU in 2025.

Thirdly, Broadcom announced it is in talks with another 2 additional hyperscalers and are in advanced development for their next generation AI XPUs, with a chance of these customers generating revenues with Broadcom before 2027.

Who might these 2 additional hyperscalers be?

I think these 2 additional hyperscalers could be Apple and OpenAI.

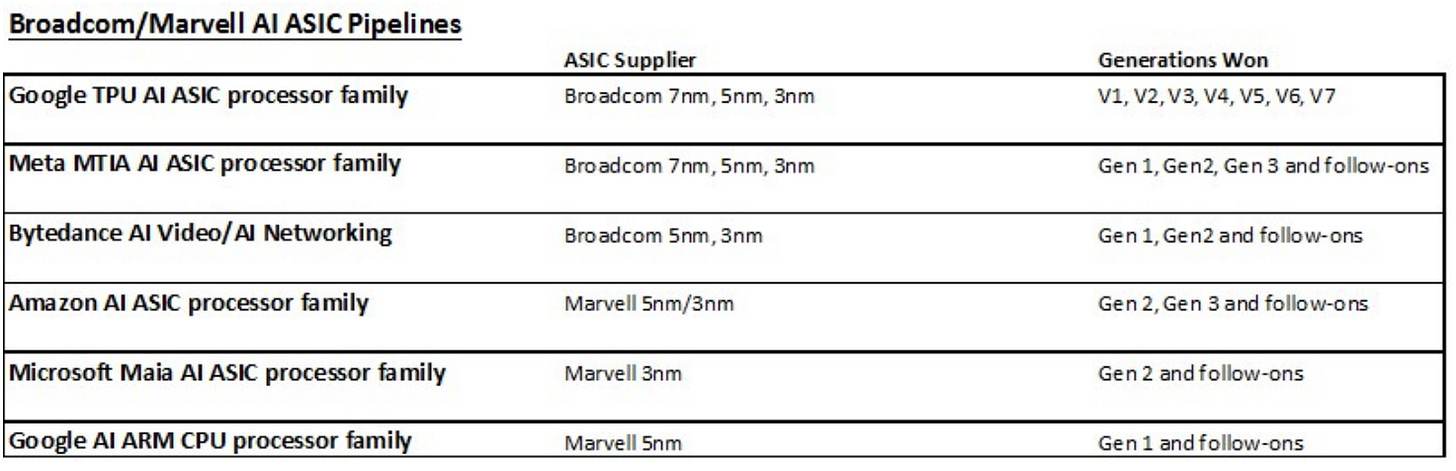

As you may all know, Broadcom has three existing hyperscaler customers developing their own multi-generational AI XPU roadmap to be deployed at varying times over the next 3 years.

These 3 existing customers are Google, Meta Platforms META 0.00%↑ and Bytedance.

Broadcom expects that each of the 3 existing customers plan to deploy 1 million XPU clusters by 2027, which translates to a serviceable addressable market of between $60 billion to $90 billion in 2027.

Management continues to see a massive opportunity for AI in the next 3 years.

I continue to expect both Broadcom and Marvell MRVL 0.00%↑ to the two leading players with the largest market share within the XPU opportunity.

Non-AI has bottomed, recovery in 2025

Within non-AI business, server storage bottomed six months ago and in 4Q24, server storage connectivity revenue recovered 20% to $992 million, while 4Q24 wireless revenue grew 30% sequentially to $2.2 billion due to a season launch by one of Broadcom’s North American customer, which also had higher content.

Still within the non-AI business, in 4Q24, after being down 51% from the prior year, broadband reached bottom at $465 million. Broadcom has seen significant orders across multiple service providers during in 4Q24 and I expect that with this stronger business momentum, the broadband business should start recovering next quarter.

On a positive note, Broadcom is starting to see with confidence that across its multiple end markets and across its product portfolio that the non-AI semiconductor business bottomed in FY2024.

From here, I expect to see a recovery of the non-AI semiconductor segment, with growth rates going back to the industry's historical growth rate of mid-single digits.

That said, the reality is that despite the bottoming of the non-AI business, in the next 3 years, Broadcom’s AI semiconductor business will significantly outgrow the non-AI semiconductor business.

With the cyclical recovery of the non-AI semiconductor business coming from 35% below their peak, this should deliver upside to operating leverage as the recovery happens.

Valuation

Before going into Broadcom’s valuation, I wanted to spend some time explaining about my financial model and assumptions made here.

Within AI semiconductors, I expect custom ASIC revenue to grow 35% next year to $10.5 billion and 50% in the following year to about $16 billion, which is a result of the ASP uplift and volume growth for TPUv6, along with the two additional hyperscaler customers, including Meta Platforms (META) ramping sharply in 2025. Note that these two are not the two new ones that Broadcom is currently in talks with, but part of the 3 existing hyperscaler customers Broadcom has today.

Within non-AI semiconductors, I assume the segment returns to mid-single digits growth rate, which is the industry’s historical growth rate.

Within infrastructure software, I expect an additional $4 billion incremental revenue from VMWare, and that forms the largest part of the business today.

As such, I share the summary of my 5-year financial model for Broadcom below. (Do note that the VMWare acquisition was done in FY2024, so you will notice from 2024 to 2025, some of the figures reflect that)

Based on the discounted cash flow model, my intrinsic value for Broadcom is $203. This assumes a terminal 2029 multiple of 30x and cost of equity of 14%.

Broadcom trades at an average 5-year P/E multiple of 39x, but given it is now a more than $1 trillion company and it's at its scale, I think a terminal multiple of 30x is more reasonable.

As I would like to ensure a sufficient margin of safety, I would enter Broadcom at a 20% discount to its intrinsic value, which implies an entry price of $162.

My 1-year and 3-year price targets for Broadcom are $229 and $275, which imply 35x and 30x 2025 and 2027 P/E multiples respectively.

I think that a slight premium on the 2025 P/E is warranted given the AI upside Broadcom is experiencing, and its AI-related peers are also trading at 35x P/E. For the 2027 P/E, similar to the terminal P/E multiple, I assume a conservative 30x P/E to derive the 3-year price target.

Conclusion

With Broadcom, AI continues to be the main driver of returns, at least in the near-term.

Both custom ASIC and AI network revenues are the key drivers within AI semiconductors, with AI semiconductors expected to significantly outgrow non-AI semiconductors.

As a result, the semiconductor solutions segment should continue to see its revenue contribution grow over the years.

Broadcom’s integration of VMWare is also rather impressive, given the company managed to accelerate its timeline cost reductions along with conversions of customers to VCF.

All in all, the company should see this higher growth profile result in better operating leverage, both across semiconductor solutions and infrastructure software segments, driving faster earnings growth over the near-term.

There’s certainly potential upside from the 2 additional hyperscalers it is talking to, but even without those additional two customers, the ramp of its 3 current hyperscaler customers will drive significant growth for its custom ASIC business.