Confluent: Starting 2025 by firing on all cylinders

Confluent is executing well on all fronts as the company is now seeing multiple tailwinds going into 2025

What used to be a messier story, the Confluent CFLT 0.00%↑ story is now starting to become cleaner as the drivers for 2025 looks solid while the downside risk looks limited.

Despite weakness that we saw with the cloud service providers like Google Cloud Platform and Microsoft Azure, Confluent managed to not only beat expectation in 4Q24, but also publish guidance for 2025 that was better than feared.

Not only that, the expanded partnership with Databricks was an important one as it affirmed that Confluent is becoming a key part of the ecosystem.

Furthermore, Confluent not only showed that it was able to have a very high win rate against major competitors, but also shared examples of how customers are migrating over to its platform and winning over new use-cases and products.

Today in this article, I will be going through:

Confluent’s solid close to 2024

Outlook that came in better than feared

Databricks expanded partnership

Market environment improving

Large customer traction

DSP customer wins

Tableflow, Freight Clusters and WarpStream

Valuation

Conclusion

Solid close to 2024

Confluent delivered solid 4Q24 results with subscription revenue growth of 24% from the prior year, 2 percentage points ahead of consensus.

The key cloud revenue figure grew 38% from the prior year, again beating consensus by 2%, driven by use case expansion across their large customer base.

Data streaming platform (“DSP”) was highlighted as growing faster than overall cloud revenue and Confluent Platform.

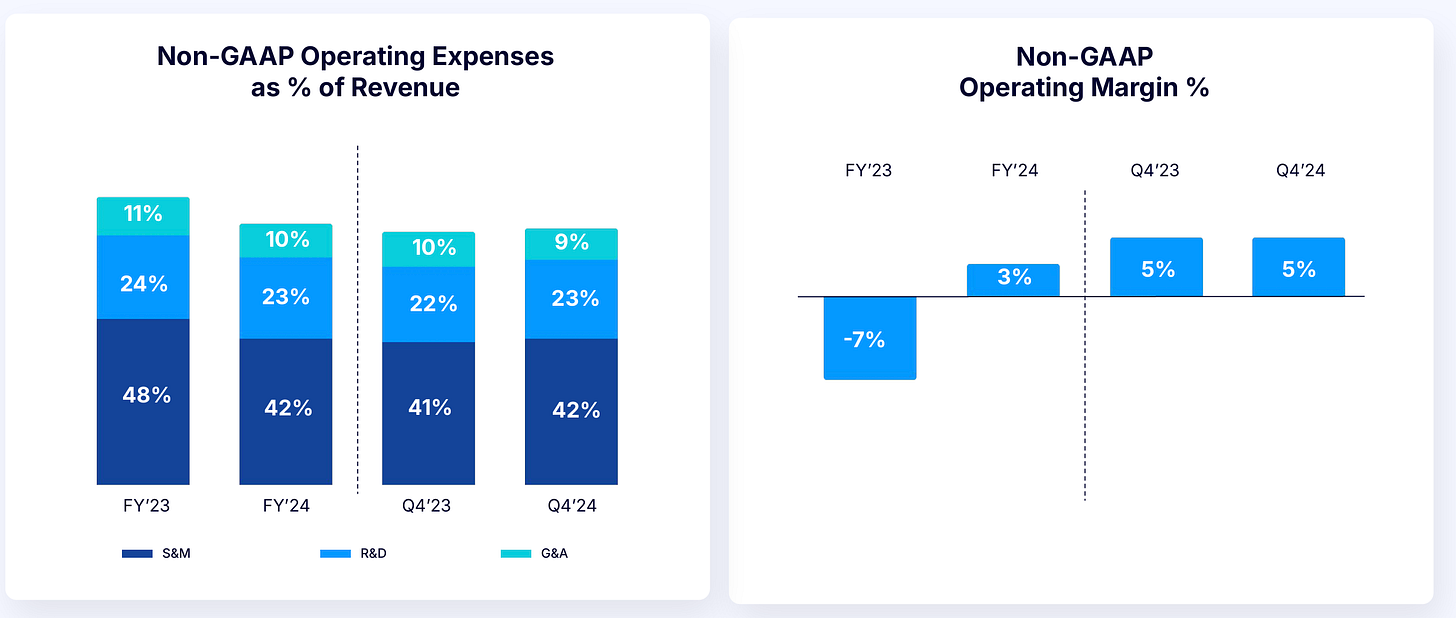

Profitability was well above expectations.

4Q24 operating margins came in at 5% beating the street by 277 basis points, while free cash flows beat consensus by $25 million.

NRR was also stable at 117%, same as 3Q24.

Outlook better than feared

The strong stock reaction post earnings was likely due to 2025 guidance coming in better than feared.

FY2025 subscription revenue is guided to $1.119 billion at the midpoint, or 21.5% year-on-year growth. This was better than the 19% to 20% that the market was expecting.

FY2025 operating margin is expected to be 6% and EPS is expected to be $0.35, which was slightly above consensus.

Management is comfortable with the current consensus dollar estimate for cloud revenue.

There are 3 drivers for guidance.

First, DSP will be one of the key drivers for growth as customers start expanding to different products and use cases on the platform.

Second, new products will also be a key growth driver, with Tableflow, WarpStream and Freight Cluster driving growth.

Third, the expansion partnerships, like the one with Databricks, will drive growth, along with the go-to-market initiatives that are reaping benefits in 2025.

Databricks expanded partnership

One of the biggest announcements made in the 4Q24 earnings was the major expansion of its strategic partnership with Databricks.

This brings a bi-directional integration between Confluent's Tableflow with Delta Lake and Databricks' Unity Catalog, providing customers with consistent real-time data across operational and analytical systems, enabling real-time interoperability and flexibility across diverse ecosystems.

For Confluent’s Tableflow, this partnership significantly extends its reach across the analytics ecosystem and improves its positioning to help application developers, data engineers, data analysts, and data scientists to power advanced analytics and next-gen AI-driven applications.

This Databricks partnership includes comprehensive go-to-market efforts encompassing field and partner enablement, solutions architectures, co-marketing, and co-selling initiatives.

In my view, the fact that Databricks partnered with Confluent is a very strong confirmation about Confluent’s role in that ecosystem, especially when it comes to AI workloads that are more real-time.

Market environment improving

Confluent is seeing “stability in the market in its different customer segments” in 4Q24, which has continued into 1Q25.

There has been overall strength in demand and slightly better certainty in terms of budgets and spending.

Management expects this to continue through 2025.

Confluent’s win rate in 4Q24 for new business continued to see a “notable increase” from a year-on-year and sequential perspective.