CrowdStrike: 3 reasons risk/reward skews to the upside (Valuation update)

1Q momentum, Falcon Flex flexing its muscles, ecosystem partners pulling weight, booming emerging business, re-acceleration in 2H and more.

Investing is all about risk/reward.

As a full-time professional fund manager, I am always on the hunt for companies trading at a discount.

That’s why when the July 2024 CrowdStrike CRWD 0.00%↑ outage sell-off occurred, I knew this was a once-in-a-lifetime opportunity to buy a high-quality company at a discount.

It has been less than 1 year since, but CrowdStrike returned more than 120% since at relatively low risk levels.

Today, the debate once again for CrowdStrike is valuation.

The company’s fundamentals and business momentum continue to be strong, with accelerating platform adoption due to Falcon Flex, customers re-Flexing after the initial Falcon Flex adoption, accelerating ecosystem partnerships, continued innovation and strong and increasing win rates.

I share 3 key reasons I think the risk/reward remains to the upside in the concluding section.

Here’s what I will be going through below:

Solid 1Q Momentum

Outlook: Puts and Takes

Falcon Flex Flexing Its Muscles

Examining the Re-acceleration In Second Half

Booming Emerging Businesses: Cloud, Identity, Exposure Management and Next-Gen SIEM

Expanding ecosystem partners

Valuation

Conclusion and 3 reasons risk/reward skews to the upside

Solid 1Q Momentum

Revenue grew 20% from the prior year to $1.1 billion in 1Q, in-line with expectations.

In Q1, we achieved net new ARR of $194 million, growing ending ARR to $4.44 billion, up 22% over last year.

Ending ARR grew 22% from the prior year to $4.44 billion, while net new ARR came in at $194 million in 1Q.

Gross margin for 1Q came in at 78% and subscription gross margin came in at 80% for 1Q.

Operating income for 1Q came in at $201 million, 12.6% ahead of expectations. This translated to an operating margin of 18%, exceeding guidance.

Despite the strong operating income performance, CrowdStrike continued to invest strategically into internal automation, go-to market, and AI innovation.

These investments are expected to drive growth in the second half of FY2026 and its long-term targets.

EPS for 1Q came in at $0.73, exceeding guidance and 10% ahead of expectations.

CrowdStrike’s cash balance grew to a record $4.61 billion as cash flow from operations in 1Q came in at a record $384.1 million and free cash flow was $279.4 million or 25% of revenue. Free cash flow was 6% ahead of expectations.

Given this strong cash balance, CrowdStrike also announced authorization for share repurchases of up to $1 billion.

The company will balance the flexibility to opportunistically repurchase shares to maximize returns and deliver increased value to its shareholders while continuing to prioritize investing in growth.

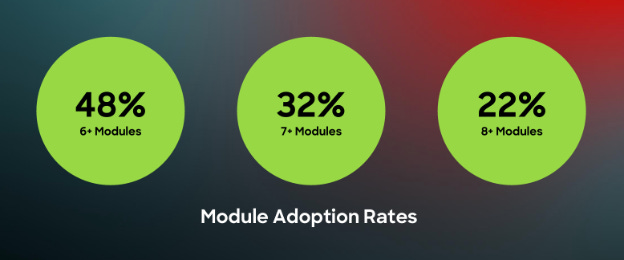

Customers continued to expand their adoption of the CrowdStrike platform, as 22% of customers have 8 or more modules, 32% of customers have 7 or more modules and 48% of customers have 6 or more modules.

Outlook: Puts and Takes

Given the strong execution, Falcon Flex momentum and growing pipeline, management is increasingly confident about its ability to improve net new ARR growth in 2Q and for re-acceleration of net new ARR and margin expansion in the second half of the year.

Part of management’s guidance for 2Q assumes sequential net new ARR growth of at least double of what we saw from 1Q to 2Q last year.

Management also continues to reiterate a near-term and temporary dislocation between ARR and subscription revenue due to the accounting standards for the CCP program, which allowed customers the one-time ability to choose more product, more time, or both, which results in an impact to subscription revenue.

This contributed to $11 million impact in 1Q and is expected to see an impact of between $10 million to $15 million for the rest of FY2026, subsiding in 4Q.

In addition, CrowdStrike’s strategic realignment plan announced in early May will result in greater efficiencies in the organization. This will result in full benefit of at least 1% higher operating margin in FY2027, increasing FY2027’s operating margin target to at least 24%.

Management shared that competitive win rates continue to be strong and it is still improving, which is what I would expect.

Furthermore, gross retention rate continued to be sustained at 97% while net retention continued to be strong and in-line with expectations.

Guidance for 2Q revenue came in the range of $1,144.7 million to $1,151.6 million, reflecting a year-over-year growth rate of 19%, 1% below expectations at the midpoint.

Guidance for 2Q EPS came in the range of $0.82 to $0.84. At the midpoint, this is 2.5% ahead of expectations.

The full-year FY2026 revenue guidance was reiterated at the same range of $4,743.5 million to $4,805.5 million, reflecting a growth rate of 20% to 22% over the prior fiscal year.

This was in-line with expectations.

The full-year FY2026 EPS guidance was increased from the earlier range of $3.33 to $3.45 to the new range of $3.44 to $3.56, an increase of 3% at the midpoint of guidance.

Falcon Flex Flexing Its Muscles

I think we are starting to see the true strength of CrowdStrike’s Falcon Flex subscription model.

For those who are new to CrowdStrike, Falcon Flex is a flexible licensing program for the CrowdStrike Falcon cybersecurity platform. It allows organizations to pre-purchase a pool of credits that can be applied to various CrowdStrike modules and services as needed. This model suits organizations seeking adaptable cybersecurity solutions without the constraints of traditional licensing.

In 1Q, the total deal value of accounts that have adopted Falcon Flex was $774 million, growing 31% sequentially and more than 6x from the prior year.

Falcon Flex has only been launched for less than 2 years, but CrowdStrike has already closed more than $3.2 billion of total account deal value across more than 820 accounts that adopted Falcon Flex.

What is the result of this accelerating adoption of Falcon Flex?

First, customers spend more as the average Falcon Flex customer deal size is more than $1 million in ending ARR.

Second, the average Falcon Flex customer also commits to longer durations of 31 months on average.

Third, Falcon Flex customers also adopt CrowdStrike’s products faster, leading to faster adoption of new products. Management shared that more than 75% of Falcon Flex contracts are already deployed.

Are Falcon Flex customers happy with the outcomes?

It appears so.

While Falcon Flex was only launched less than 2 years ago. 39 Falcon Flex customers have already deployed their initial Falcon Flex contracts and are returning to the company for a re-Flex.

These 39 customers had an average contract duration of 35 months (almost 3 years on average), and within 5 months, they are returning to CrowdStrike to upsize and re-Flex to accelerate and achieve their cybersecurity consolidation goals.

Here’s an example of a Falcon Flex customer:

A Fortune 100 technology firm became a CrowdStrike customer with an initial EDR contract for $12 million for a 3-year period before Falcon Flex was launched.

After Falcon Flex was launched, the customer executed a more than $100 million 5-year contract, more than 8x the initial deal as the customer took the opportunity to modernize and consolidate on CrowdStrike. This new Falcon Flex deal expanded into securing cloud workloads, and next-gen SIEM and displaced 2 legacy SIEMs in the process.

This customer utilized 95% of this Falcon Flex deal in just 9 months and in 1Q, re-Flexed to further consolidated with CrowdStrike, further expanding Falcon endpoint protection and Falcon Cloud Security to more business units.

Through the re-Flex deal, this customer doubled their initial Flex subscription and it now spends almost 20x their initial EDR purchase, replaced more than 8 point products and deployed more than 10 Falcon modules.

What is Falcon Flex’s impact on CrowdStrike?

I think Falcon Flex is clearly a game changer.

In the past, it used to take much longer for CrowdStrike to consolidate legacy and competitor point products due to procurement complexity and being locked into legacy products.

Today, Falcon Flex’s flexibility is accelerating what would have taken years of sales cycles and making consolidation a reality.

CrowdStrike’s Falcon Flex subscription model is accelerating platform adoption faster than the company has ever seen.

The growth we are seeing with Falcon Flex helps improve confidence in improving sequential net new ARR growth in 2Q and accelerating net new ARR in the second half of the year.