Google: Improving fundamentals support EPS expansion

Google's Search, YouTube and Cloud businesses are all showing strength, supporting the company's continued investments into AI infrastructure.

Google GOOG 0.00%↑ GOOGL 0.00%↑ continued to show the market that its Google Search business remains resilient while its Google Cloud business accelerates.

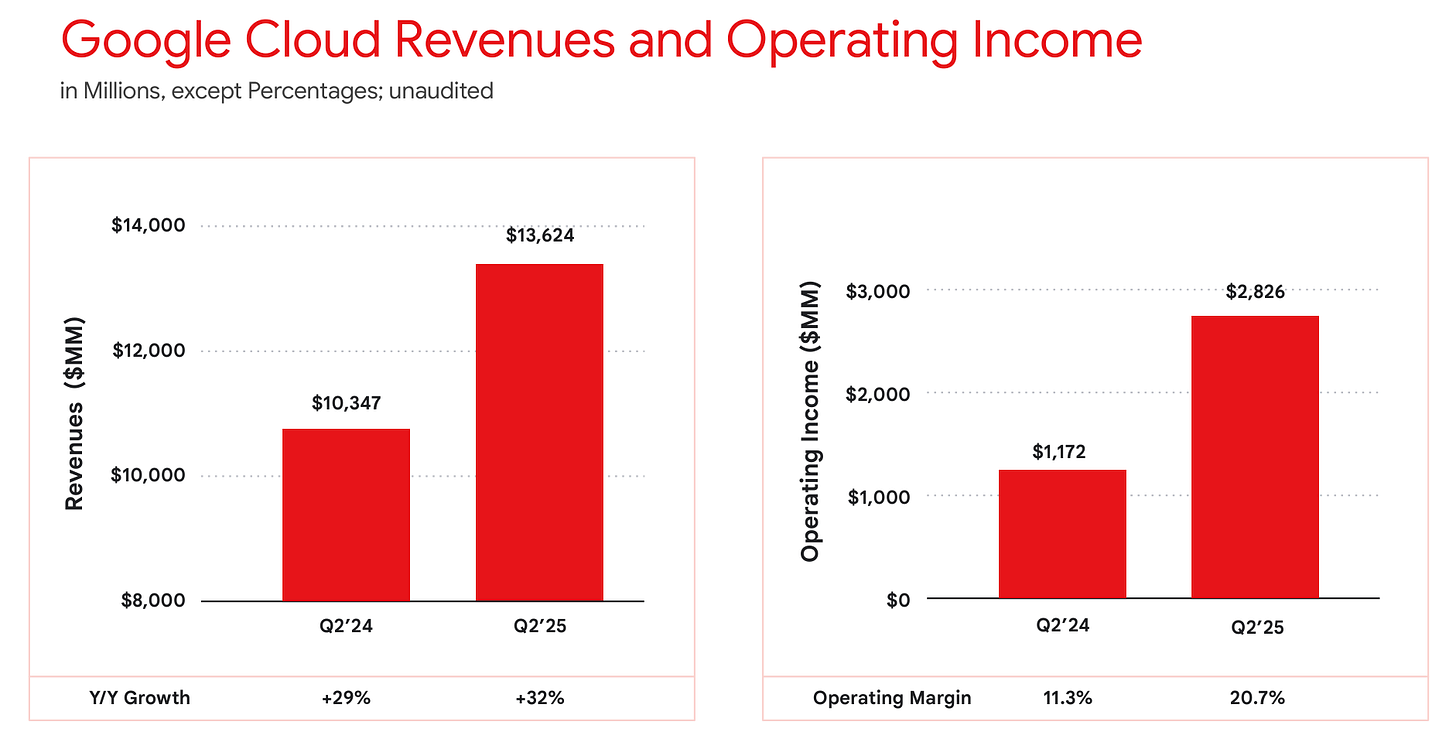

Despite the growing capital expenditures, Google has managed to expand profitability, with Google Cloud operating margins growing 940 basis points to 20.7%.

I also highlight some data points that show that Google Cloud’s customer demand is strong and growing.

With that strong Google Cloud demand in mind, management is raising capital expenditure spending in 2025 by $10 billion or about 13%.

Management also shared that based on the visibility that they have, they expect 2026 capital expenditures to be higher than that of 2025, which bodes well for AI demand.

Best quarter in a while

Google Cloud acceleration

Strong demand supports investments

Capital expenditures tells a story

Google Search

YouTube

Waymo

Conclusion

Best quarter in a while

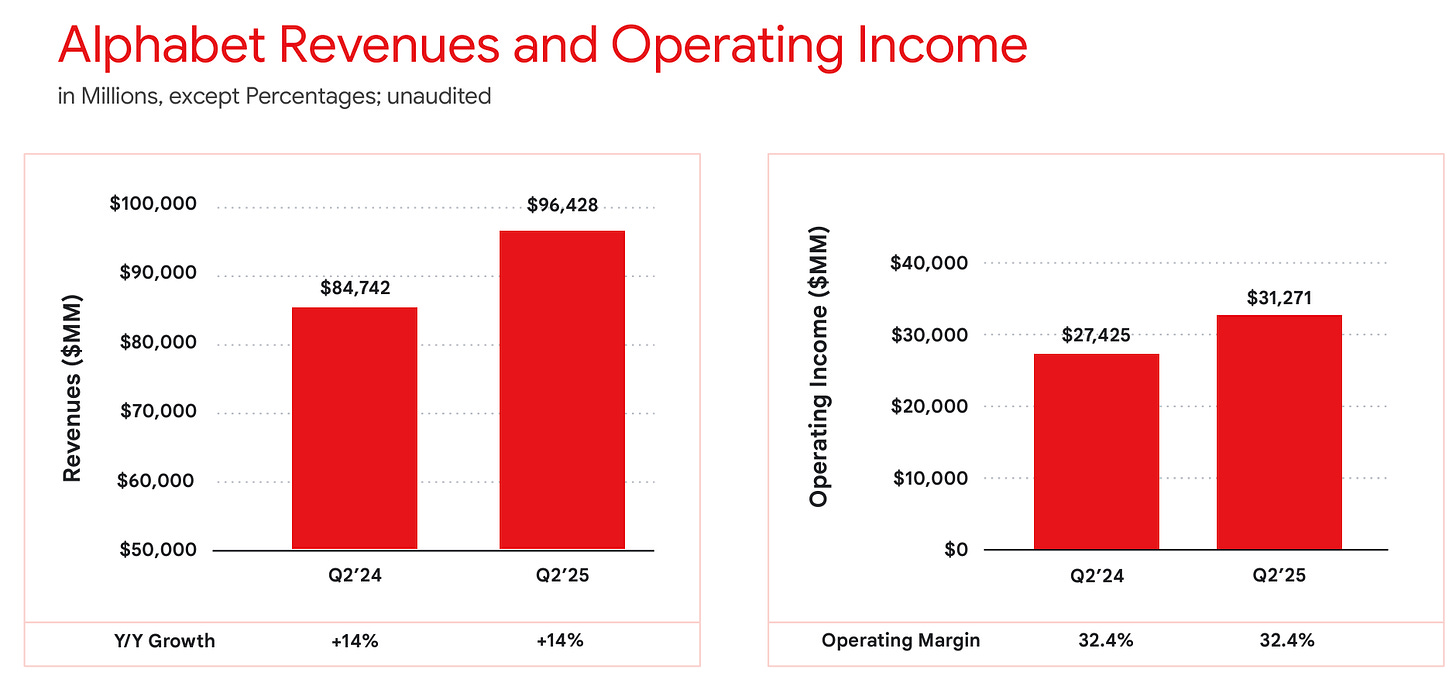

Google reported total revenues of $96.4 billion, up 13% year-on-year in constant currency.

This was 3% ahead of consensus expectations.

By segment, Google Cloud revenue grew 32% from the prior year to $13.6 billion and was 4% ahead of consensus expectations.

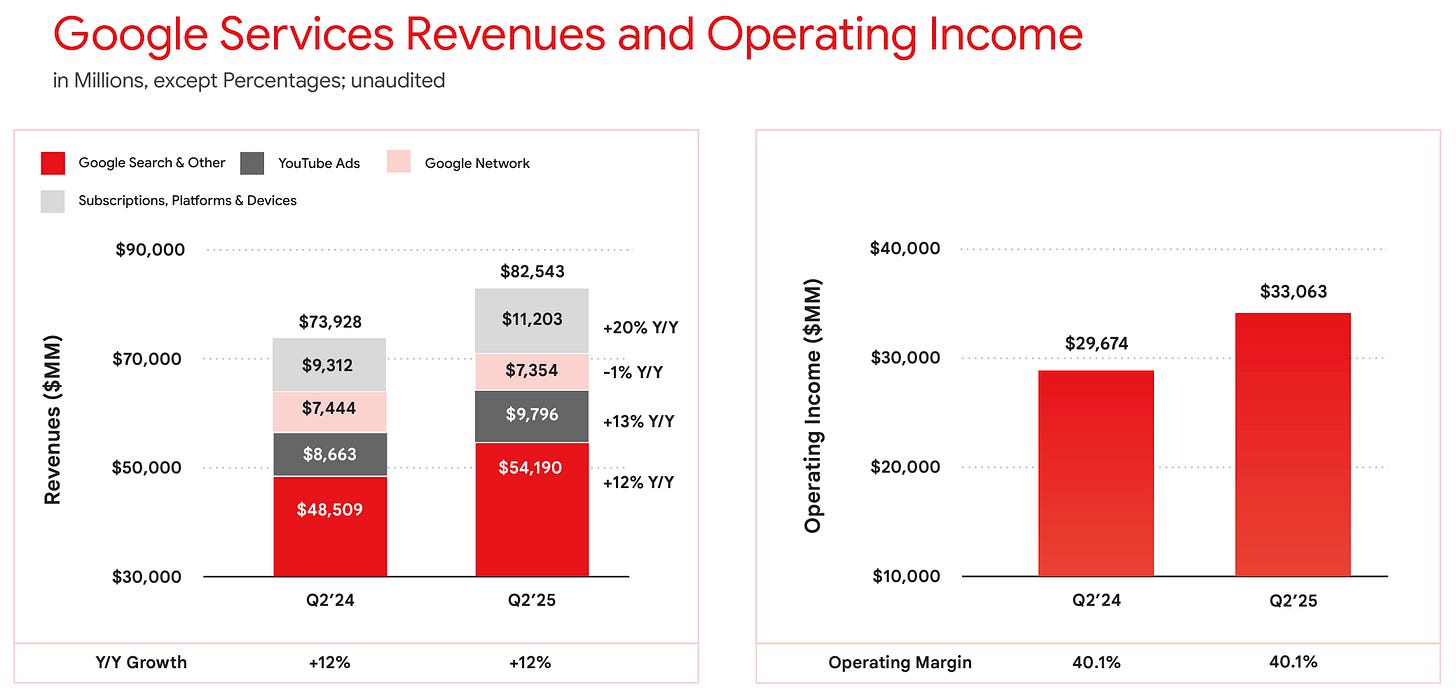

Within the Google Services segment, Search & Other revenues grew 12% from the prior year and was 2% ahead of consensus expectations, while YouTube ad revenue grew 13% from the prior and was also 2% ahead of consensus.

Subscriptions, Platforms & Devices revenue grew 20% from the prior year, largely due to the strength in subscriptions which was contributed by YouTube subscriptions, Google One, Google AI Pro and Ultra plans.

Given that Search & Other revenues came in above expectations, this shows the durability of Google’s Search ads business.

Google’s operating income came in at $31 billion, translating to 32.4% operating margin.

Operating margin was stable this quarter despite an increase in operating expenses by 20% from the prior year due to the revenue upside.

Operating income was 1% ahead of consensus expectations.

By segment, Google Cloud operating income was 27% ahead of consensus, while Google Services operating income was 1.5% ahead of consensus.

EPS came in at $2.31, 6% ahead of consensus expectations of $2.18.

Google Cloud acceleration

This was a solid quarter for Google Cloud.

Google Cloud revenue of $13.6 billion increased 32% from the prior year and was 4% above consensus expectations.

The year-on-year growth of 32% was a 360 basis points acceleration from the prior quarter.

Google Cloud’s operating profit margin of 20.7% was also very strong given that the market was expecting only 16.7% operating margin for the quarter.

Google Cloud operating profit margin went from 11.3% in the quarter last year to 20.7% this quarter.

This operating profit margin expansion was achieved as Google Cloud recognized higher technical infrastructure costs, including depreciation, as the strong revenue outperformance and continued efficiency improvements more than offset that.

Google Cloud remains in a tight demand and supply environment going into 2026.

Demand for its cloud products and services continues to be strong and Google is investing to increase the deployment of new capacity.

Management did highlight that the growth in Google Cloud in the quarter was from both core and AI products.

The company also highlighted that it is seeing “significant demand” for its AI product portfolio.

Google did highlight that AI research labs like Safe Superintelligence and Physical Intelligence were using their TPUs (Google’s very own custom silicon), which is good news for Google’s TPU initiative.

Looking forward, Google continues to focus on “driving improvements in productivity and efficiency to offset growth in technical infrastructure-related expenses, particularly from higher depreciation”.

Towards the back half of 2025, Google continues to expect to bring more data centers online.

Strong demand supports investments

There are multiple data points that suggests that customer demand for Google Cloud is strong and growing.

First, Google Cloud backlog reached $106 billion at the end of the 2Q25 quarter, increasing 18% sequentially and 38% from the prior year.

Second, the number of deals over $250 million doubled from the prior year.

Third, Google Cloud signed the same number of deals over $1 billion in the first half of 2025 as it did in all of 2024.

Fourth, Google Cloud new customers grew 28% from the prior quarter, suggesting new customer traction is growing.

Finally, Google Cloud saw more than 85k enterprises build with Gemini, with Gemini usage growth 35x from the prior year.