Mobileye deep dive: Asymmetry in autonomy

Everything you need to know to invest in Mobileye

10 years ago, autonomy seemed like a distant dream.

For investors, there was more hype than actual investment opportunities given how early the industry and technology was.

Today, I believe that it is not if, but when full autonomy is achieved.

More importantly, what is different today is that global automotive companies are starting to plan their autonomous vehicle roadmap and incorporating the technology into the vehicles of today.

Tesla TSLA 0.00%↑ is where most investors are focused on, and given its more than $1.2 trillion market capitalization that it has today, it is clear that the market is pricing in its autonomy opportunity into the stock as well.

However, when doing a deep dive into the autonomous vehicle or self driving industry, be it the LiDAR players like Innoviz INVZ 0.00%↑ and Luminar LAZR 0.00%↑ or global OEMs like Volkswagen, one name kept appearing.

And that name is Mobileye’s MBLY 0.00%↑.

After diving deeper into Mobileye, I realized this was a company where not many investors understood very well in terms of the opportunities and the upside potential.

In fact, I think given where we are at with its share price and the number of programs going this is a stock within the autonomous vehicle and self driving space that I think has a significant upside potential.

Let's start looking into Mobileye!

Today in this article, I will be going through:

Introduction and background

Mobileye product suite

Industry adoption and standards

Mobileye competitive advantages

Manufacturing strategy

Management team and shareholding

Competitive landscape

Advanced product engagement pipeline

2024 innovation day

Valuation of Mobileye

Risks

Brief introduction

In 1999, Mobileye was founded by Professor Amnon Shashua.

In the early days, Shashua worked with two close friends, Ziv Aviram and Norio Ichihashi. Aviram was in charge of the operations, finance and investor relations while Shashua was in charge of the strategic vision, technology and R&D of the company. Ichihashi was in charge of the Asian market, which was Mobileye's first market.

In 2014, the company went public and in 2017, Intel INTC 0.00%↑ acquired the company and took it private. After the acquisition, Shashua became the CEO and Aviram retired. Another key management personnel is Dr. Gaby Hayon, who led R&D in Mobileye since 2005 and still do so today.

Mobileye’s success today is a result of 25 years of focusing on solving autonomy since its humble beginnings.

Since its founding, Mobileye has led the mobility revolution by using its expertise in machine learning, computer vision, mapping, its purpose-built EyeQ SoC, and data analysis.

The company's technology has enabled a comprehensive portfolio of Advanced Driver Assist ("ADAS") and Autonomous Vehicle ("AV") solutions. At the end of the day, its solutions are meant to bring about not just autonomy but safety.

Mobileye has been focused on ensuring its technology is scalable, low cost and efficient since founding. In addition, the company currently is profitable and growing rapidly, while having the experience of working with more than 50 automakers in the world.

As can be seen below, these are the key milestones of Mobileye, which includes the first EyeQ chip shipped in 2007 and shipping to 160 car models across 25 automakers in 2015. (More on EyeQ next)

More technology progress was made after 2015 as the effects of its work compounded.

In 2018, Mobileye began crowd sourcing map data globally (More on maps in a later section), in 2021 it carried out AV testing across 3 continents and it also shipped its 100 millionth EyeQ in 2021.

Mobileye's product suite

When I think of Mobileye's product suite, I see it as building blocks that range from ADAS to AV.

These building blocks are scalable and utilizes the company's advantages in data and its experience to custom design high performing and low-cost solutions.

Today, Mobileye’s current business is made up of 95% ADAS (EyeQ chips) and 5% SuperVision.

SuperVision is Mobileye’s hands-off and eyes-on solution. This is expected to be the next near-term growth driver for Mobileye as a large part of the pipeline deals with SuperVision, including design wins with Audi, Porsche, Polestar and Zeekr and more.

Mobileye Chauffeur and Mobileye Drive are its eyes-off solution and driverless solution, which are expected to ramp later in the decade.

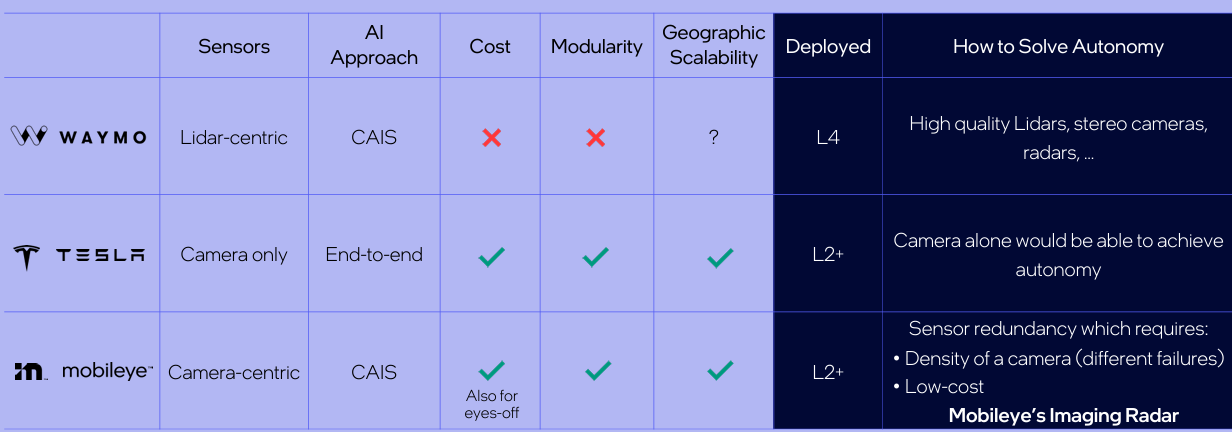

Mobileye takes a different approach from Waymo and Tesla.

Tesla take the view that the camera alone will be able to achieve autonomy.

Waymo is on the other end, where it takes the view that to achieve autonomy, you need high quality Lidars, cameras and radars, amongst others.

Mobileye is somewhat in between in that it aims to solve autonomy using sensor redundancy through the use of its imaging radar and using a camera-centric approach, thereby allowing for low costs.

Waymo is currently deployed on L4 while Tesla and Mobileye are deployed on L2+.

Let’s dive right into each product category.

EyeQ

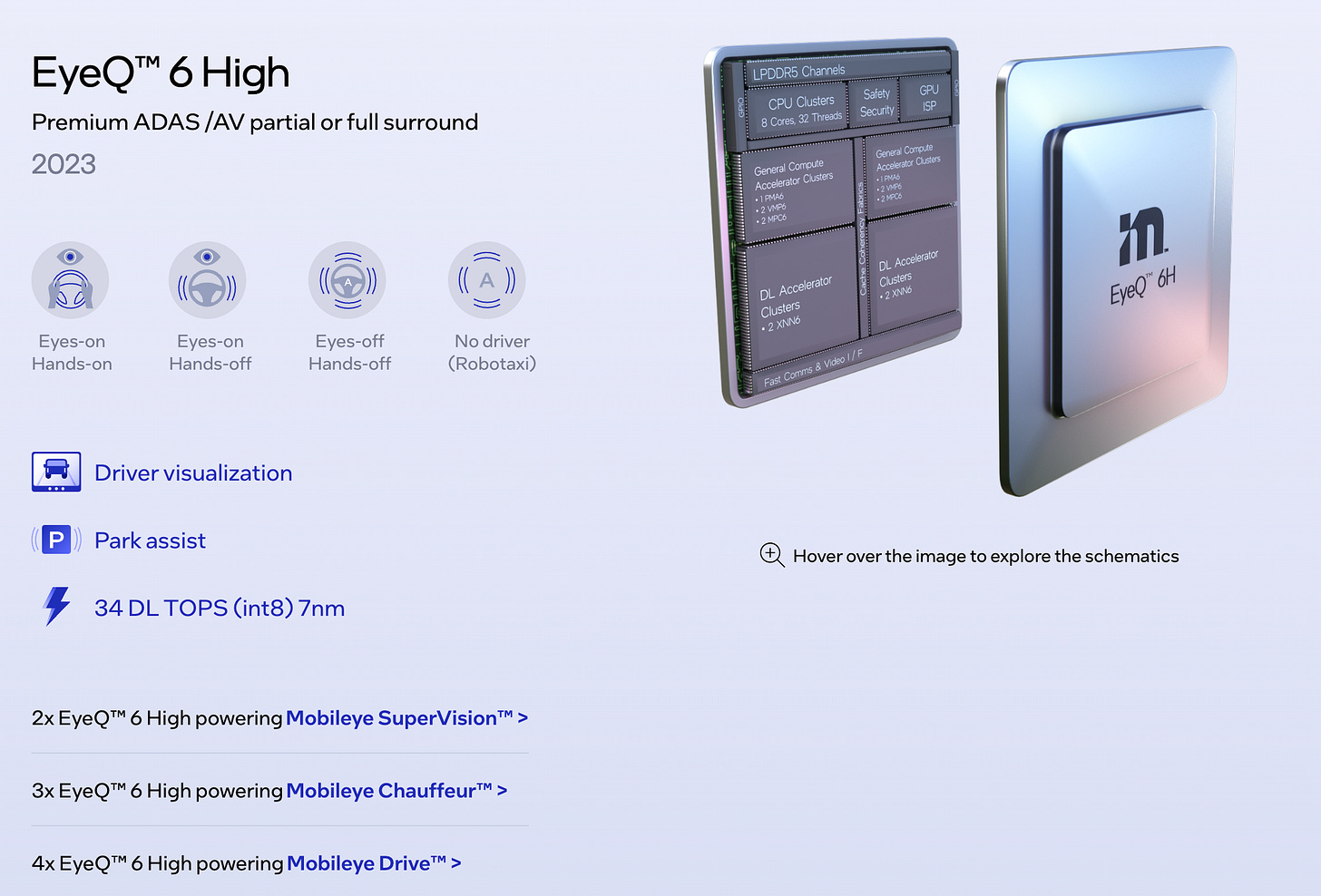

Firstly, at the core of all Mobileye offering is its purpose built EyeQ System-on-Chip (“SoC”).

The EyeQ chip is a scalable and automotive grade SoC that is tailored for the needs of ADAS to AV.

The current EyeQ portfolio includes EyeQ 4 that is meant for core ADAS, EyeQ 5 that is meant for premium ADAS and EyeQ 6 that is meant for premium ADAS and AV.

As Mobileye progresses along the EyeQ series, the company continues to use its know-how and expertise to design a chip for customers that has the maximum efficiency to enable them to manage power consumption and costs.

As can be seen below, after six generations of EyeQ, more than 50 automakers have incorporated EyeQ into their vehicles and more than 800 models have used EyeQ in their vehicles.

After more than 20 years of technological improvements, there are now more than 140 million vehicles on the roads that use EyeQ.

Second, Mobileye offers customers it's what is called REM, or Road Experience Management, which is its crowdsourced mapping layer. '

Mobileye's REM is a unique solution for AV mapping because it is camera-based, crowdsourced and uses specialized algorithms.

The result is a low cost, scalable solution that leverages the network effect of large datasets.

Mobileye's REM crowdsourced maps are available for enhanced ADAS, SuperVision and consumer AV offerings.

The maps are essential for providing a critical intelligence layer for onboard sensors and brings additional data on the drivable paths.

At the end of the day, this is another way in which Mobileye differentiates itself as its AV maps allow for fully automated map generation, that can be updated near-real time, with superior local accuracy and it is highly scalable as well.

Third, Mobileye offers RSS, which stands for Responsible Sensitive Safety, which is a formal model that governs safety and assumes the worst-case assumptions for other road users. This is currently only available on SuperVision, consumer AV and RoboTaxi applications. RSS is essentially a framework that governs the driving policy stack, in addition to the perception layers housed on the chip. It sets a formal model to govern the complex decision making involved in automated driving applications. The end result is a driving policy stack that is safe, assertive, computationally lean and highly scalable.

I highlight the five safety rules of RSS below:

Don’t hit the car in front of you.

Don’t cut in recklessly.

Right of way is given, not taken.

Be cautious in areas with limited visibility.

If you can avoid a crash without causing another one, you must.

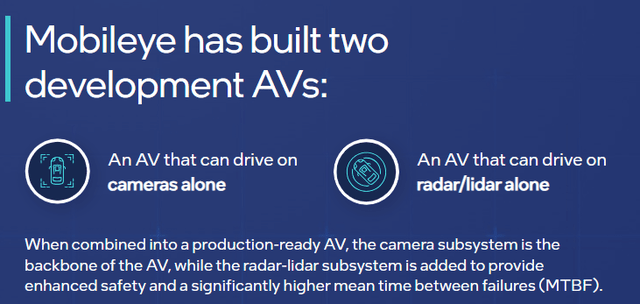

Fourth, when moving up to L4 applications, the need for additional redundancies results in the need for imaging radar or LiDAR subsystems. Mobileye is currently in works to develop an imaging radar and a Frequency-Modulated Continuous Wave ("FMCW") LiDAR. As many of Mobileye's SuperVision customers are likely wanting to add LiDAR and radar, I think we will see the company expand to radar and LiDAR offerings to SuperVision, consumer AVs and RoboTaxi applications starting the middle of the decade.

Mobileye's approach is different from the current players in the industry because of something it calls True Redundancy. The Mobileye approach is different from that of the industry because the industry approach is that camera and radar are complementary, meaning that both the camera and radar-LiDAR sensors combine their sensing of the environment into a single model. However, in Mobileye, they task each channel, camera and radar-LiDAR to sense all elements of the environment and each channel has its own model, leading to two separate full models that are trained independently of each other to bring superior performance and easier validation.

Lastly, Mobileye's Autonomous-Mobility-as-a-service ("AMaaS") also offers fleet management applications for customers. Some of these capabilities come from an Intel acquired urban mobility app, Moovit. Moovit also brings another critical intelligence or data layer for Mobileye needed for fleet utilization.

We will now move on to SuperVision.

In my view, SuperVision will be key to driving a 30% revenue CAGR for Mobileye in the long-term, along with margin expansion given the higher value nature of the product. There is a strong pipeline of SuperVision program launches to come in the next 1 to 2 years, which provides strong visibility into its growth.