Quanta Services: Resilient business, secular tailwinds

Limited tariff impact and strong backlog despite macro backdrop

Quanta Services has benefits from both growth tailwinds and a resilient and predictable business model.

With growing demand for power and modernization of the grid, the company has a long-term runway ahead of it as a key enabler of this secular trend.

With a strong backlog position and continued momentum with current and new customers, the company also has sufficient visibility into the near-term and medium-term prospects of the business.

True to this, Quanta Services not only beat expectations this quarter, but also raised guidance in an uncertain environment.

Furthermore, it reassured investors that there is limited tariff impact on its business and has included risks into the guidance that was revised higher.

I share more about my opinion and analysis about the company below.

Brief introduction to Quanta Services

Solid start to the year

Raising guidance

Business fundamentals (Electric Infrastructure)

Business fundamentals (Underground & Infrastructure)

Limited or no tariff impact

Strong demand trends

Valuation

Conclusion

Brief introduction to Quanta Services

The company has 2 segments, the Electric Infrastructure segment and the Underground & Infrastructure segment.

The Electric Infrastructure segment makes up 80% of revenues and the remaining 20% is contributed by the Underground & Infrastructure segment.

The Electric Infrastructure segment includes the electric grid solutions, the technology and load center solutions, and the power generation and energy storage solutions.

This is Quanta Services fast growing segment given the growing power needs and demand.

As utilities need to upgrade their aging grid, the electric grid solutions is well positioned for that.

As data centers require more power, the technology and load center solutions is well position for that.

As utilities and independent power producers require more power generation and energy storage capabilities, the power generation and energy storage solutions is well positioned for that.

The Underground & Infrastructure segment is relatively more stable, with low to mid-single-digit percentage growth opportunities available.

The segment includes the company’s our industrial solutions and gas utility and pipeline integrity services. There continues to be maintenance requirements and regulatory needs to upgrade and modernize these systems, which should help generate recurring revenues for the business.

Furthermore, gas generation demand has been increasing, which is also driving demand for its gas infrastructure solutions business.

Solid start to the year

Quanta Services started the year strongly.

1Q25 revenues came in at $6.2 billion, growing 24% from the prior year or 6.3% organically.

This was 6% ahead of consensus expectations.

1Q25 EPS came in at $1.78 per share, beating consensus expectations by almost 7%.

Raising guidance

With the strong start to the year, Quanta Services raised full-year revenue guidance from the earlier range of $26.6 billion to $27.1 billion to the new range of $26.7 billion to $27.2 billion. At the midpoint of this new guidance, this is in-line with consensus expectations of revenues of $26.9 billion.

Adjusted EBITDA guidance for the full-year 2025 was also raised from the earlier range of $2.49 billion to $2.62 billion to the new range of $2.68 billion to $2.81 billon.

Adjusted EPS guidance for the full-year 2025 was also raised from the earlier range of $9.90 to $10.50 to the new range of $10.05 to $10.65. This was 2% ahead of consensus expectations.

Free cash flow guidance was left unchanged between $1.2 billion-$1.7 billion.

In my opinion, while the raise in guidance was not significant, the fact that Quanta Services can still be raising guidance in what I see as an uncertain macroeconomic environment speaks volumes.

This tells me that there continues to be strong visibility across its core end markets and that with continued execution, the company still can meet its now higher guidance.

Business fundamentals (Electric Infrastructure)

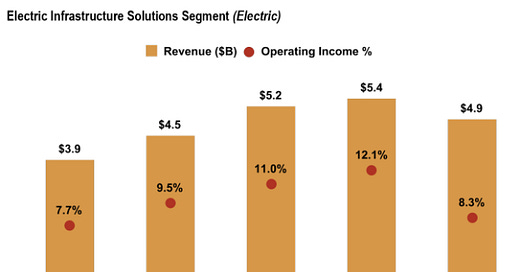

Electric Infrastructure revenues came in at $4.9 billion, growing 8.3% organically and coming in 4% ahead of consensus expectations.

The strong revenue beat was due to the strong demand across the segment, including strength in the power generation and energy solutions segments.

Operating margin for the segment came in at 8.3%, in-line with consensus expectations.

The backlog for the Electric Infrastructure segment grew 4% sequentially from $28.6 billion in 4Q24 to $29.7 billion in 1Q25.

This was a new record for the segment, due to strong volumes from current customers and project awards from new customers.