ServiceNow: High quality software company becoming an AI platform of choice

The company has a strong track record of excellent execution and it is amongst a few rare software companies becoming a true AI platform

ServiceNow NOW 0.00%↑ executed beautifully against a very high bar.

From a growth perspective, cRPO not only beat expectations but also accelerated, revenue easily beat the high bar of expectations.

Profitability also beat expectations as operating income handily beat expectations.

Even more important is that ServiceNow continues to do well operationally, landing and expanding more and larger deals, and even demonstrating strength in the AI space.

ServiceNow is able to stand out amongst its enterprise software peers in terms of not only its ability to consistently execute through a challenging IT spending environment, but also show best-in-class monetization of AI.

As such, I attribute most of ServiceNow’s success to company specific factors, including execution and innovation.

Business review

This was a beat-and-raise quarter for ServiceNow.

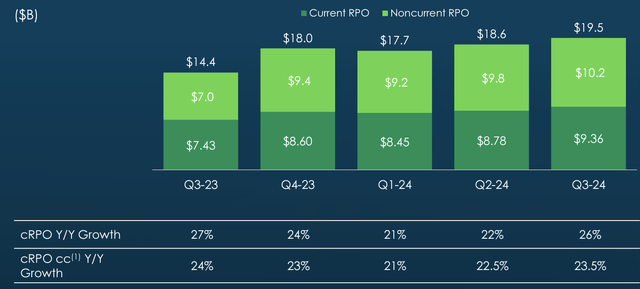

cRPO grew 23.5% on a constant currency basis from the prior year, beating market consensus by 113 basis points and beating guidance by 150 basis points.

This represents an acceleration in growth from last quarter's 22.5% growth on a constant currency basis.

There will be some people who will comment that this is less than the 200 basis points beat from the prior quarter, but to me, a beat is a beat.

Subscription revenue grew 22.5% on a constant currency basis, beating its own guidance by 200 basis points and market consensus by 190 basis points.

Operating income came in at $872 million, an increase of 29% from the prior year and coming in 8% higher than market consensus.

Operating margins came in at 31.2%, an increase of 150 basis points from the prior year and coming in 171 basis points ahead of market consensus.

Guidance

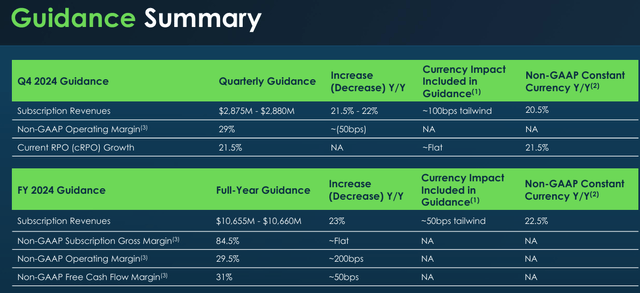

Revenue guidance for 2024 was raised after the outperformance in 3Q.

ServiceNow expects revenue to grow at 23% or 22.5% on a constant currency basis for 2024 relative to 2025. This was 100 basis points ahead of market consensus.

For the fourth quarter revenue growth was guided to be 21.8% or 20.5% on a constant currency basis, which beat expectations by 100 basis points as well.

cRPO growth on a constant currency basis for 4Q is expected to come in at 21.5%, which was in-line with expectations.

Operating income for 4Q is guided to be $851 million at the midpoint, or 29% operating margins.

This was slightly weaker than expected as market consensus was at 30.6% operating margins.

This is likely just due to the timing of the expenses given the strong 3Q operating income upside.

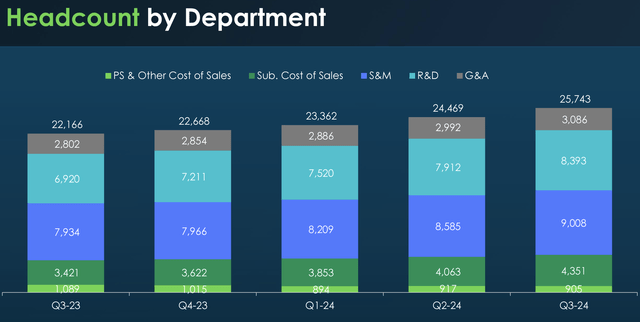

Specifically, ServiceNow mentioned in the past that headcount growth for 2024 will be back half weighted, with the vast majority of the sales and marketing hiring being quota-bearing reps.

In my view, the meaningful growth in operating expenses growth in the second half alongside additions in headcount signals ServiceNow's confidence in the opportunity ahead.

ServiceNow expects to see similar levels of headcount growth in the next few quarters ahead given the opportunity they see with everything, including Now Assist, Agentic AI, the workflow data fabric and all the other innovation ServiceNow is bringing to the table.

At the same time, the hiring and headcount growth is done prudently and quarter by quarter so that it has the ability to pivot if it deems necessary.

For 3Q at least, we saw headcount grow by 16%, with R&D growing at 21% and sales and marketing grow 14%.

R&D has always been a huge focus for ServiceNow and so the growth in R&D headcount has been consistent. This will continue to be a place where ServiceNow invests in given that in the age of AI, there is just so much innovation that ServiceNow's engineering team can bring to the table.

At the same time, ServiceNow continues to invest in quota-bearing sales reps but there's some operating leverage there now as ServiceNow is benefiting from the effects of scaling its sales and marketing operations over the years.

One hire this quarter that is worth highlighting is Amit Zavery, who will be joining as President, Chief Product Officer and COO.

Coming from Alphabet GOOG 0.00%↑ , Amit was the General Manager of Google Cloud, where he helped scale revenues from $7 million to more than $4 billion today. Prior to Google Cloud, he was at Oracle where he was in charge of their growth of the Platform-as-a-Service and data analytics.

Looking at the overall environment, namely the buying environment and macro, it remains largely similar to the prior quarter and continues to be a value-based market and a market that is highly interested in AI.

The pipeline looks healthy, with CEO William McDermott even stating that “I do believe that the best days of growth are far in front of us. I see that in the pipeline.”

Strong operational metrics

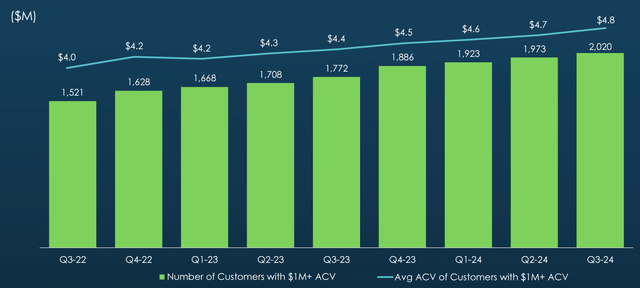

ServiceNow continues to see a growing number of customers spend more on its products and services.

The number of customers with at least $1 million in ACV grew 14% from the prior year to 2,020.

On top of that, the average ACV of this group continues to grow, increasing 9% to $4.8 million as the largest customers on the platform continue to grow with ServiceNow.

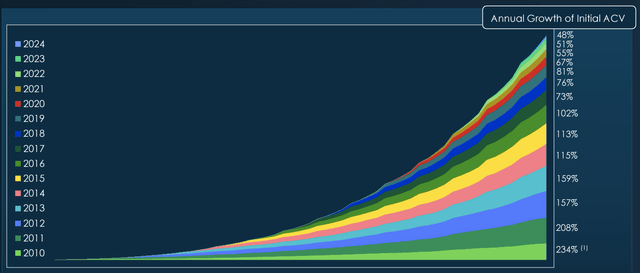

Speaking of customer expansions, this is one of my favorite charts from ServiceNow and probably an envy of most software companies.

The oldest cohorts from 2010 to 2013 continue to see growth in ACV each year, which is an encouraging sign that ServiceNow's oldest customers are still growing with the company.

At the same time, the younger cohorts from 2021 to 2024 have a huge potential given where the older cohorts have expanded to.

But most importantly, through this one chart alone, ServiceNow managed to show that not only that it is highly successful in landing and expanding with customers, but also doing so consistently over more than a decade.

In 3Q, ServiceNow had 96 deals with at least $1 million in net new ACV.

It also landed the second largest logo deal in the company's history, along with a second customer that passed the milestone of more than $100 million ACV.

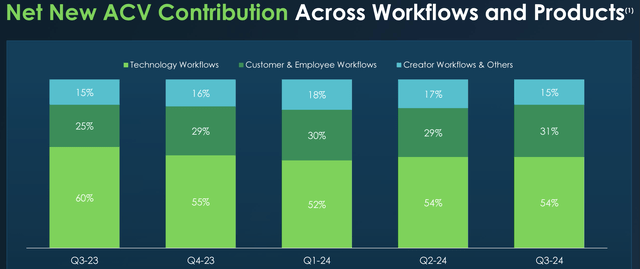

The strength is across the entire ServiceNow platform.

In the top 20 deals for 3Q, IT asset management were in all of them, creative workflows were in 17 of them, ITSM, ITOM, and customer workflows were in 15 of them, Security and Risk were in 14 of them, employee workflows were in 13 of them.

Creative workflows had 13 deals with more than $1 million, while employee workflows had nine deals more than $1 million.

Customer workflows had 17 deals with more than $1 million, Security and Risk had 11 deals with more than $1 million and ITSM and ITOM had double digit deals with more than $1 million.

In particular, we see a growth in the net new ACV contribution from the customer and employee workflows in 3Q, given this workflow is relatively new and less mature than the technology workflows.

ServiceNow has been delivering consistently above the Rule of 50, which really demonstrates its quality and high level of execution.

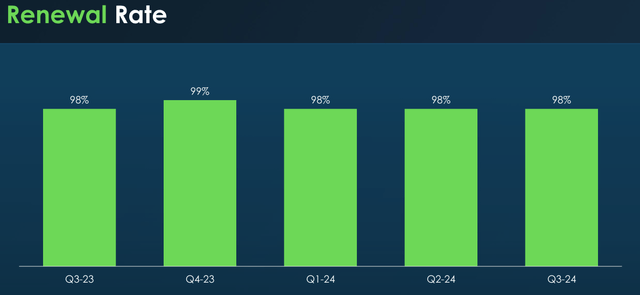

Below, we will see the all-familiar renewal rate for ServiceNow, which remains best-in-class.

Growing partnerships

ServiceNow significantly expanded its strategic partnership with Nvidia NVDA 0.00%↑ to accelerate the enterprise adoption of Agentic AI.

Through the use of Nvidia Agent Blueprints, both companies will co-develop native AI Agents within the ServiceNow platform.

This is expected to bring new AI use cases to the platform where customers can just turn on.

In addition, ServiceNow and Siemens announced a new collaboration where the two companies intend to improve industrial cybersecurity and also drive innovation and integration of generative AI into shopfloor operations.

Siemens will be providing the Siemens' Sinec Security Guard for industrial vulnerability management and the Siemens Industrial Copilot for generative AI‑powered automation, alongside ServiceNow's workflow automation.

Other partnerships ServiceNow made include one with Rimini Street to enable companies to unlock value with legacy ERP systems, and another one with Pearson to help use AI to improve the workforce development and employee experiences.

Focus on innovation

As highlighted above, one of the key spending areas of ServiceNow is R&D for innovation.

In 3Q, with the Now Platform Xanadu release, ServiceNow launched hundreds of new AI capabilities. Some of these new AI capabilities are generative AI solutions purpose built for specific industries, including the telecom, technology, financial services, public sector, amongst others. Now Assist Skill Kit is another capability launched with the release.

In addition, Agentic AI will be integrated into the ServiceNow platform, thereby enabling ServiceNow AI Agents to reach a large scale, with the first use cases being within customer service management and IT service management.

ServiceNow also launched the ServiceNow Workflow Data Fabric in 3Q, which is an integrated data layer meant to unify business and technology data across a company, thereby enabling workflows and AI agents to work seamlessly. This will be powered by Automation Engine and RaptorDB Pro high‑performance database.

AI

ServiceNow is fast becoming a leading AI platform for business transformation.

Unlike other companies, ServiceNow’s AI business actually validates the shift towards AI and the very strong interest customers have in AI.

ServiceNow is one of the rare companies that provide details into their AI business

Now Assist currently has 44 customers that are spending at least $1 million in ACV.

Of those, six spend at least more than $5 million and two spend more than $10 million.

Now Assist is now the fastest growing product in ServiceNow’s history.

Pricing continues to be healthy as plus SKUs continue to have more than 30% price uplift relative to Pro in 3Q.

ServiceNow is also seeing rising demand from customers for Now Assist as a result of customers seeing the improvements in productivity and cost savings expected from using Now Assist.

It’s also interesting to note that most of the generative AI deals have been sold direct, so there’s also more growth levers from enabling partners to sell these deals.

Valuation

Despite being at a relatively large scale at almost $9 billion in revenues in 2023, the debate for ServiceNow is more about how long it can sustain 20% revenue growth for.

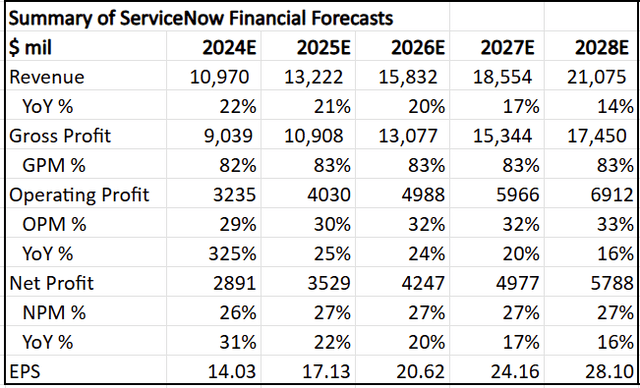

For now, I assume 20% revenue growth to continue through 2026, and for this to taper down in 2027 and 2028.

However, this could prove to be conservative if software spending grows more than expected.

Most of the margin expansion comes from operating leverage due to scale benefits, growing operating margin from 29% in 2024 to 33% in 2028.

Using the discounted cash flow model, I derive my intrinsic value for ServiceNow to be $922.

Here, the key assumptions include 50x terminal 2028 P/E multiple and 12% cost of equity. The cost of equity is derived from Bloomberg.

Based on a comparable peer group of software companies that is growing similar to ServiceNow and at a larger scale like Palo Alto Networks PANW 0.00%↑ and Microsoft MSFT 0.00%↑ , the average forward P/E multiple of this group is 55x. As such, assuming a 50x terminal multiple applies some conservatism to that peer group and is justified in my view.

My 1-year and 3-year price target are $956 and $1240 respectively. They imply 55x 2025 P/E and 50x 2027 P/E respectively, which again, based on the comparable peer group, is reasonable, in my view.

Conclusion

The 3Q result once again showed ServiceNow's business remains solid operationally and management's execution is on another level.

This is a stock where the positioning is no doubt crowded and the bar is set high for the company to reach, but nevertheless, it has been delivering and beating expectations quarter after quarter.

ServiceNow continues to invest in both innovation and sales engines that will enable the company's growth engine to continue firing.

ServiceNow is fast becoming the AI platform of choice for customers for business transformation, with many proof points showing that not only customer demand is strong, but there are tangible benefits in the form of improvements in productivity and cost savings.

Thank you for reading the entire article!

If you enjoyed this, do share it on Substack or on other platforms so that this article can reach and benefit others too.

Big fan! I worked v. closely with ServiceNow last year - their AI capabilities are insane, customer service teams and levels of customer support are going to be unrecognisable in a year or two.

impressive to see ServiceNow nail growth and profitability while going all-in on AI.