Snowflake: The Sridhar effect

With continued strong core business and AI product ramps, I expect a strong 2025 for Snowflake

Snowflake SNOW 0.00%↑ showed investors that it is just getting started.

It has been exactly 1 year since Sridhar Ramaswamy first transitioned as CEO of Snowflake.

Snowflake’s very strong guidance for FY2026 product revenue highlights strength in the business in a few areas, which I will go through below.

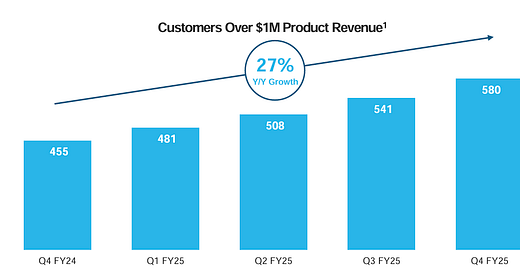

Firstly, the core business is very strong and expected to continue to be strong.

Secondly, new AI product ramps will drive further visibility into the second half re-acceleration of revenues.

Thirdly, the go-to-market team has improved significantly and been a key muscle in driving new customer acquisition and ramping up, while new products are driving a strong momentum in the business.

Lastly, the company is seeing good visibility into existing customers looking to migrate workloads into the Snowflake platform, which should drive revenue growth in the second half as well.

Today in this article, I will be going through:

FY4Q25 results

Solid FY2026 guidance

Drivers of growth for FY2026

The Sridhar effect

Traction in AI

Valuation

Conclusion

FY4Q25 results

Snowflake’s product revenue was up 28% from the prior year and came in at $943 million.

This was a 3% beat relative to consensus expectations, and for a company executing at this scale, I think 28% growth is impressive.

Snowflake’s profitability was well ahead of expectations in FY4Q25.

Product gross margins came in at 76% and operating profit margins came in at 10%, ahead of consensus expectations by 1 percentage point and 5 percentage points respectively.

This was driven by year end cost management that resulted in lower sales headcount.

All that translated to EPS of $0.29, 61% ahead of expectations.

Solid FY2026 guidance

Snowflake guided product revenue for FY2026 to be at 24% year-on-year growth.

If we assume the usual 3 percentage points beat of guidance given the typical conservatism baked into the guidance, we could even see product revenue head to 27% growth.

This is well ahead of consensus expectations of 23% revenue growth for FY2026.

The FY2026 guidance assumes stable growth within its core business, with new product features to contribute to a re-acceleration in the second half of FY2026.

For profitability, management guides a slight margin decay to product gross margin to 75% due to higher AI product mix, which was expected.

In the longer term, management sees scope for product gross margin to improve due to easier GPU access.

Operating profit margin is expected to expand slightly from 6% in FY2025 to 8% in FY2026 as management continues to ramp investments for generative AI growth in the business.

Management highlighted that in view that there is going to be a CFO transition due to the retirement of the current CFO, they continue to see that a 3% beat of guidance is solid and that they feel confident about the guidance set for the next quarter and next year.

I do think management is relatively prudent and thoughtful to balancing growth and profitability.

Given the strong revenue growth expected for FY2026 and growing contribution from AI revenues, this gives them ample leeway to drive more investments into growth areas. At the same time, management is highly selective in hiring.

Management highlighted that even as it focuses on accelerating innovation and new product delivery, they are committed to scaling efficiently. The headcount growth in FY2026 is focused on engineering and sales, teams which will help drive direct impact to revenue. The company is also using AI internally to drive costs down and improve efficiency, which will help improve costs as well.

CEO Sridhar also mentioned that “it is this operational rigor that we instituted in FY2025 that is now our way of life going forward, investing in growth while having a maniacal focus on driving efficiencies throughout our business”.

Drivers of growth for FY2026

Where is the confidence for the top-line growth coming from?