The Trade Desk: Attractive risk/reward profile after the sell-off

Diving deeper into whether this is just market noise or a fundamental issue

Since its peak in December 2024, The Trade Desk TTD 0.00%↑ has seen its share price plunge more than 40% to levels not seen since a year ago.

Is this drastic share price movement justified or does this bring a contrarian opportunity?

Today, in this article, I will share my findings and analysis about the problems that The Trade Desk may be facing, highlight the reasons for this drastic drop in share price, and explain whether this creates a compelling opportunity or value trap.

When the share price reacts so dramatically to the 4Q24 results and guidance, it is likely due to a change in rhetoric where investors suddenly lose confidence and trust in the company’s long-term vision.

However, for longer term investors, this could create an opportunity if, firstly, there is relatively little or no changes to the fundamentals of the company, and secondly, if management is making the right steps to drive the company towards long-term success (albeit with short-term impacts).

Today in this article, I will be going through:

Introduction to The Trade Desk

Business overview

Growth strategy

Management team

4Q24 business review and 1Q25 guidance

Management’s full ownership of the missteps

Execution missteps and re-organization

Competition

Kokai transition

Valuation

Concluding thoughts about the stock

Introduction to the company

(Skip this section if you are familiar with The Trade Desk)

The Trade Desk is a leading ad-tech company specializing in programmatic advertising, offering a comprehensive demand-side platform for digital marketers and advertisers.

The company was founded in 2009 and since then, The Trade Desk has established itself as the largest independent demand-side platform globally.

Being a demand-side platform means that the company is focused on the buy side. The buyers control the advertising budgets and because the supply of digital advertising inventory exceeds demand, it is largely a buyer’s market. By focusing only on the buy side, The Trade Desk is able to avoid conflicts of interest that exist when serving both the buy and sell side. In the long-term, The Trade Desk is able to build trust with its clients as many of them use their own data on The Trade Desk’s platform.

Business overview

The Trade Desk provides a cloud-based programmatic advertising platform that enables clients to manage digital advertising campaigns across various channels, including display, mobile, video, audio, native, and connected TV (“CTV”).

The company generates revenue by charging these clients a platform fee based on a percentage of a client’s total spend on advertising.

The company also generates revenues when it provides data and other value-added services and platform features.

The Trade Desk has a highly sticky business model as its customer retention rate is typically above 95%,

The Trade Desk’s clients are advertising agencies, brands and advertisers.

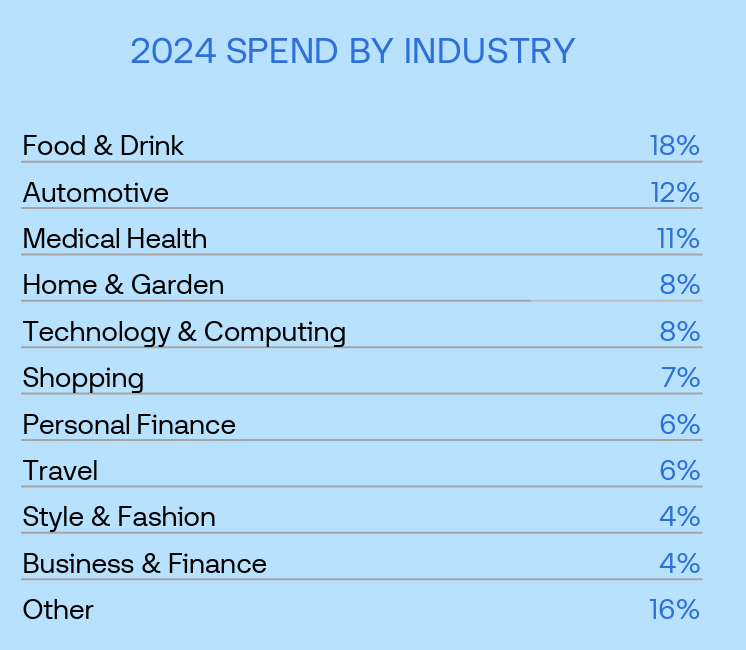

While The Trade Desk serves various industries, the largest segments of its customer base are the Food & Drink, Automotive and Medical Health industries, making up 18%, 12% and 11% of spend in 2024 respectively.

While CTV is The Trade Desk’s largest media channel, there are other media channels like Mobile, Display and Audio.

The shift of advertising dollars to CTV continues to be a core driver for The Trade Desk’s business.

As of 4Q24, CTV made up high 40% share of the business and this share continues to grow, and Mobile made up mid-30% share of the business, while Display and Audio made up low-double digit and 5% share of the business today. Spotify is becoming a key partner with The Trade Desk within the Audio segment as they expanded their partnership in October 2024 when Spotify announced that it was partnering with The Trade Desk to connect its video ad inventory to North American advertisers, while also joining the Unified ID 2.0 framework to offer privacy-safe targeting.

By geography, North America represented about 88% of spend and International represented about 12% of spend for 4Q24. International growth is a key growth driver and in 4Q24, International revenue growth was faster than North America for the eighth quarter in a row.

Growth strategy

Talking about the International segment brings me to the growth strategy of The Trade Desk.

As mentioned above, growing its international presence is one of its growth strategies as about two-thirds of global advertising spend is outside the US.

The second growth driver would be to increase its penetration within existing clients. The goal here is as these advertisers move more of their advertising budgets to programmatic channels, this will enable The Trade Desk to win a larger pie of their spend.

The third growth driver is then of course to grow its client base by bringing in new relationships with advertising agencies and brands.

The fourth growth driver is to expand its omnichannel capabilities to offer clients capabilities across media channels while continuing to grow and gain share within CTV.

The fifth growth driver is innovation in technology, data and measurement to continue to improve the capabilities and features of the platform. This will enable the company to remain ahead of competitors and have an edge in the game.

Management team

I think The Trade Desk has an excellent leadership team and this is a founder-led business which significant skin in the game.

As you will see below, most of the management team have been with the company for a long time and rose through the ranks internally.

Jeff Green is the CEO of the company, and he also founded the company in 2009.

In fact, Jeff has been the CEO since the beginning, so he was instrumental to the company’s successful IPO, rapid growth, expansion into international markets and leading one of the most successful ad tech companies in the world.

Jeff adds significant credibility to the company’s ability to execute just given how he has been able to lead the company through the years and during its time as a public company, consistently beat the market’s expectations.

He owns 811k shares of The Trade Desk, at the time of writing, which amounts to $65 million. Of course, this would have been worth much more before the sell-off, which is likely the reason he has been selling off some shares recently.

Based on the 2023 filings, Jeff has been receiving a salary of just $1 million in 2023, which of course is just about 1% of what he owns in the company. From the table below, you can see he barely has any increment in salary from 2021 to 2023.

In addition to the $65 million of stock he owns, the alignment with shareholders also comes from option awards and stock awards, which made up more than 80% of his total compensation in 2023.

Tim Sims was appointed Chief Commercial Officer in January 2024, where he oversees the global client services organization and the inventory partnerships team.

Tim has been with the company for more than 10 years, and before his CCO appointment, he was the Senior Vice President of Inventory Partnerships, where he drove the company's strategy and execution in creating cutting-edge supply-side collaborations with partners around the world and across multiple channels including video, audio, mobile, native and display.

Jed Dederick was also appointed Chief Revenue Officer in January 2024 and he is in charge of driving the company’s revenue generation and new client acquisition globally.

He has been with the company since 2012 and he was the first member of the company’s sales team, and thereafter, served as Regional Vice President of East Coast Sales and North American Head of Sales. As you can tell given his long tenure at the company, he was key to the company’s growth and developing the company’s sales capacity.

Finally, Laura Schenkein is the Chief Financial Officer of The Trade Desk and was appointed in 2023. She has been with the company since 2014 and before becoming CFO, she served in a variety of roles in financial planning and analysis.

4Q24 review and 1Q25 guidance

Total revenue for 4Q24 came in at $741 million, growing 22% from the prior year. This was below consensus by about 2%.

Adjusted EBITDA came in at $350 million or 47% adjusted EBITDA margin in 4Q24, below the guidance of $363 million or 48% adjusted EBITDA. This was also below consensus expectations by 4%.

GAAP EPS came in at $0.36, ahead of consensus of $0.33.

The full year 2024 gross spend was $12.041 billion, growing 25% from the prior year and implying a 20.3% take rate. This is somewhat in-line with consensus expectations of $12.2 billion and 20.1% take rate.

1Q25 revenue was guided to be at least $575 million, growing 17% from the prior year. This fell short of consensus expectations by just 1%.

1Q25 adjusted EBITDA was guided to be $145 million or 25% margin, well below consensus expectations of $192 million or 33% margin. As such, adjusted EBITDA came in 24% below consensus expectations, due to factors that will be explained in subsequent sections.

There will be a modest increase in operating expenses in 2025 which will result in some deleverage in the year.

The modest margin compression will be due to the investments will be made in areas like infrastructure and talent, along with the efforts to correct the missteps related to the reorganization of the company to better position it to scale into the long0term growth opportunity, as will be explained below. This includes hiring more senior leadership, including a Chief Operating Officer.

However, The Trade Desk’s capital intensity remains low, with capital expenditures making up only 5% of revenues.

In my view, these investments are necessary and even prudent from the long-term despite a near-term margin compression as there are real risks from underinvesting.

I still expect adjusted EBITDA margins to remain well ahead of pre-covid levels of low-30% and I expect leverage to return in 2026, turning into a tailwind then.

Fully owning the missteps

Before starting on the 4Q24 results and outlook, I wanted to first highlight management’s comments and ownership of the quarter’s results.

“While we’re proud of these milestones, I want to acknowledge up front that for the first time in 33 quarters as a public company we fell short of our own expectations.

During COVID we revised our expectations once along with the rest of markets, but for the first time in 8 years we missed the expectations we set, and it was our fault.

Our success to this point has been fueled in part by our ability to win trust with investors, partners, our industry, and our customers. There are very few things that rival that in importance to us. I want you to know that we take this moment seriously. And we want to assure our investors, partners and customers that their trust is well placed and deserved.

Our brightest days are still ahead of us.”

Again, management reiterated that the miss was not due to competition or market opportunity, but due to a “series of small execution missteps” while preparing for the future.

“Starting off, let me explain it as I see it, what falling short of our own expectations does NOT represent. This didn’t happen because the opportunity isn’t as big as we thought. In this case, it isn’t because of competition either. For Q4, the reality is that we stumbled due to a series of small execution missteps while simultaneously preparing for the future.

If this were a sporting event, we’d still have a championship caliber team, but in this particular game, we turned over the ball too many times. That said, we see a larger and faster growing market than we originally expected, which is why we have been making changes and will continue to do so. Simply put, as you have seen before, as companies grow and become increasingly complex, they need recalibration to unlock new opportunities. We are recalibrating our larger company for an even stronger future.”

Management could have very easily pleased investors by making decisions that maximize the short-term at the expense of the long-term. While that could have led to a beat this quarter, this would cost The Trade Desk much more further down the road.

I think that the company’s reorganization efforts today, while it has a short-term cost in terms of margins, will position it to maximize shareholder value for the long-term.

Execution missteps and reorganization

Management placed 100% of the explanation of the 2% miss of 4Q24 revenue guidance and 1% miss of the consensus for the 1Q25 revenue guidance on internal execution missteps.

The key point here is that management is seeing zero incremental headwinds from macroeconomic factors or competition.