Zscaler: Winner in this environment

Macro commentary, Z-Flex, emerging products traction, Red Canary acquisition, new CFO and more

The engine of success looks likely to continue for Zscaler ZS 0.00%↑ in this environment.

First, Zscaler’s platform continues to be resilient in this environment while others have seen weakness due to its critical nature and its focus on AI.

Second, to improve this value proposition and help customers bring more value in this environment, Z-Flex was launched. Z-Flex is expected to grow meaningfully in FY2026, and I expect this to be a driver of growth for the next fiscal year.

Third, we are seeing the fruits of labour of the go-to-market transition and with Mike Rich coming in to lead the sales organization 1.5 years ago, with sales productivity leading solid growth in billings, RPO and revenues.

Fourth, Zscaler has up-and-coming emerging products that are expected grow faster than the more mature products and contribute meaningfully to growth in this year and beyond.

Finally, the Red Canary acquisition expands Zscaler’s capabilities and go-to-market team while the new CFO brings greater certainty into the investment case.

Here’s what I will be going through in the article below

3Q: Solid across the board

Macro and outlook commentary

Strong customer momentum

ServiceNow calibre sales organization

Emerging products: Gaining momentum

Red Canary acquisition

CFO hired

Valuation

Conclusion

3Q: Solid across the board

Compared to other cybersecurity results we have seen in the past month, Zscaler produced very strong results.

First, billings did not just accelerate from 18% y/y growth last quarter to 25% y/y growth this quarter, but it also beat expectations by 4 percentage points, coming in at $784.5 million.

Secondly, unscheduled billings growth came in at 28% in 3Q, up from 25% in 2Q and 20%+ in 1Q, highlighting yet another quarter of improving sales execution. RPO accelerated from a strong quarter in 2Q of 28% y/y growth to 30% y/y growth in 3Q, signalling customers are increasing their commitments with Zscaler.

Third, revenue grew 23% from the prior year to $678 million, ahead of the high end of its guidance of 21% y/y growth and 2% ahead of expectations.

Fourth, there was upside to both free cash flow and operating margins. Free cash flow came in at $113 million, 13% ahead of expectations, while operating margins came in at 21.6%, 44 basis points ahead of expectations.

Unscheduled billings grew 28% y/y for 3Q while guidance implies unscheduled billings growth of just 25% y/y for 4Q. The company increased FY25 guidance across all metrics, with revenue and profit outperformance passed through to the full year outlook.

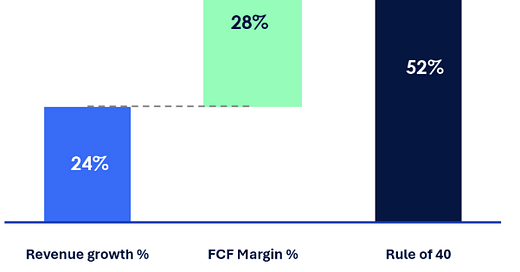

With the 24% year-to-date revenue growth and 28% free cash flow margin, this means Zscaler is operating at a rule of 52 year-to-date in 2025 with 3 quarters down.

Furthermore, the company has operated above the rule of 40 for 5 years now.

Macro and outlook commentary

I think management’s macro commentary was better than expected.

Zscaler management shared that they “did not see a softer April”.

While management acknowledged that the environment remains challenging and IT budgets remain tight, Zscaler is in the sweet spot of cybersecurity and specifically Zero Trust Architecture, and AI.

While customers may be pulling out budgets for IT spending lower in the priority list, both Zero Trust Architecture and AI remain priority spending areas for customers.

To ensure that Zscaler is helping customers add value and improve on return on investment, the company launched a new purchasing program called Z-Flex in 3Q to help customers more quickly eliminate legacy security and networking products like firewalls.

If you think Z-Flex sounds familiar, it is probably because of CrowdStrike’s Falcon Flex and I think Zscaler is learning from CrowdStrike here.

Z-Flex will enable customers to have the flexibility to adopt products on the Zscaler platform as their needs evolve, adding or changing modules based on their needs.

Since launch, Z-Flex commitments contributed to more than $65 million in TCV bookings.

Management shared that an existing Fortune 500 technology customer made a multi-year commitment under the Z-Flex program, increasing their ARR by over 40% to $19 million and also added managed threat hunting, micro-segmentation, identity threat detection, GenAI protection, and several data security modules.

Zscaler expects Z-Flex to “grow meaningfully in the next fiscal year”.

Due to the strong 3Q, Zscaler is increasing FY2025 guidance across the board.

Billings growth was increased from the prior range of 20% to 21% y/y growth to 21% to 22% y/y growth.

Revenue growth was increased from the prior 22% y/y growth to the new 23% y/y growth.

Operating profit margin was increased from the earlier range of 21% to 22% margin to the new 22% margin.

EPS guidance was narrowed and increased to between $3.18 to $3.19, an increase of 4% at the midpoint.

Free cash flow margin was increased from the earlier range of 24.5% to 25.0% to the new range of 25.5% to 26.0%.

Management reiterated that as Zscaler continues to introduce new products which are growing strongly, because these new products are optimized for go-to-market rather than margins.

As these new products ramp, they will continue to be headwinds on gross margins.

After this initial period of launch, the company will then optimize these new products for margins over time as they scale.

Strong customer momentum

Zscaler continued to see strong large customer momentum this quarter.

Customers with more than $1 million ARR grew 23% from the prior year to 642.

This supports a trajectory that puts Zscaler on track to surpass $3 billion of ARR in 4Q.

Lastly, Zscaler’s 12-month trailing dollar-based net retention rate was 114%, which was solid and remains stable relative to the past few quarters.

That said, Zscaler continued to highlight that because it is increasingly selling in larger bundles with multiple pillars to customers, this could result in variability in this metric on a quarterly basis.

ServiceNow calibre sales organization

A large part of the strong results we see Zscaler post today is due to its improving sales organization.

About a year and a half ago, Zscaler brought in Mike Rich, who came from ServiceNow.